Tutti i contenuti di 4200blu

-

Transizione ecologica ed il futuro della mobilità

Si vero, ma questi 21% sono il risultato di un output di anche ca. 20% in medi dalla potenza installata totale. questa e esattamente il problema, un rendimento medio del impianto abbastanza scarso, anche in un paese molto solegiato, figurati al nord con spesso mal tempo come Germania o Polonia. (electricitymap)

- Il futuro dei siti produttivi Stellantis

- Il futuro dei siti produttivi Stellantis

-

Transizione ecologica ed il futuro della mobilità

Spain announces $1.5 billion package to boost electric vehicle market MADRID, Dec 3 (Reuters) - Spain will provide nearly 1.3 billion euros ($1.52 billion) to support its electric vehicle market and industry next year as part of a plan to lift the share of EVs produced in the country to 95% by 2035, Prime Minister Pedro Sanchez said on Wednesday. In the first 10 months of 2025, the share of fully electric and plug-in hybrid vehicles made in Spain totalled around 10%, industry data show. Self-charging hybrids accounted for 26.7%. Around 20% of vehicles across the EU last year were fully electric or plug-in hybrids. Spain's plan includes 400 million euros in direct subsidies in 2026 for consumers to buy EVs and another 580 million euros under the country's EU-funded scheme supporting industrial investment. It will also add 300 million euros to install charging points along roads still lacking coverage. Spain is stepping up support for its automotive sector as Chinese EV brands like BYD (002594.SZ), opens new tabrapidly expand, undercutting European rivals and exploiting the country's lack of a strong domestic carmaker. The plan intends to help the domestic auto sector maintain jobs as production shifts to EVs and ensure Spain remains Europe's second-largest car manufacturer, Sanchez said. Foreign battery projects such as Chinese company CATL's (300750.SZ), opens new tab 4 billion euro plant with Stellantis (STLAM.MI), opens new tab are creating jobs in Spain, but without domestic backing the country risks losing know-how and market share. Under the Spanish roadmap, sales of electrified models are targeted to reach 100% by 2035. (Reuters)

-

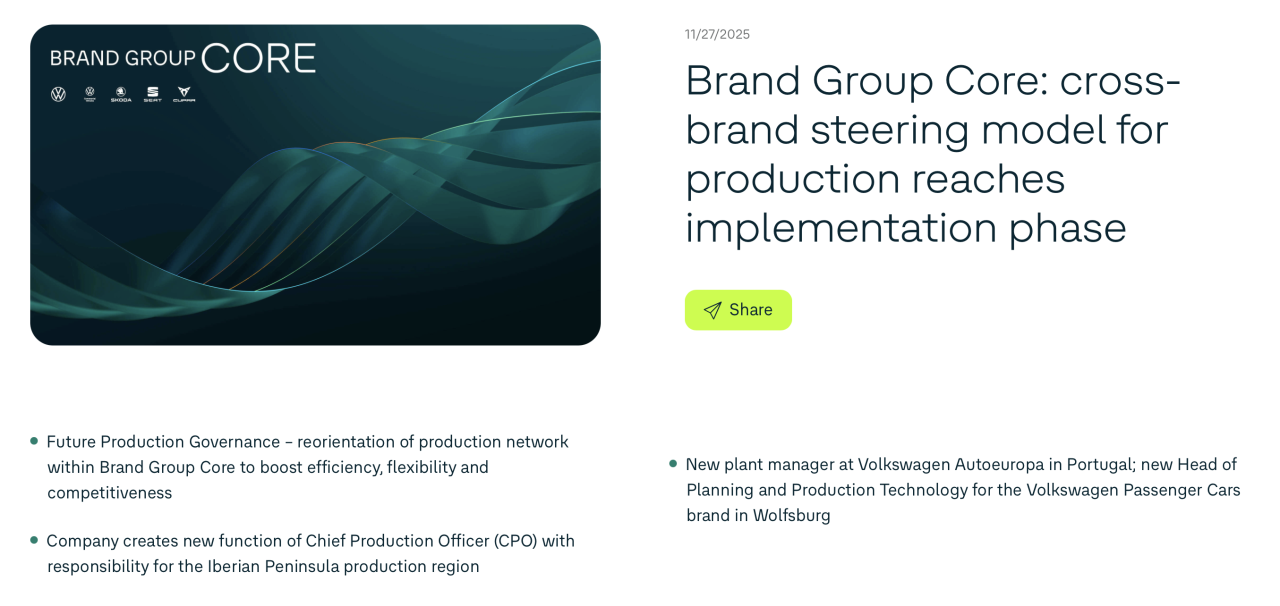

Scelte strategiche gruppo Stellantis NV

China: FAW allegedly ready to invest in LeapmotorThe potential equity investment by the FAW Group in Leapmotor appears to be nearing completion, with signing expected later this year. However, it is becoming clear that FAW will take a smaller stake than initially anticipated. Rumours about the state-owned automaker’s potential investment in the rapidly growing EV startup had already surfaced over the summer. Since spring 2025, the two companies have collaborated on their first joint vehicle project. The progress achieved, Leapmotor’s consistently strong sales figures, and its financial performance appear to have convinced FAW’s decision-makers to invest in the company. Leapmotor’s founder, chairman, and CEO, Zhu Jiangming, has now confirmed the ongoing discussions, stating that the company will not relinquish actual control. According to the latest reports, FAW intends to acquire around 5 per cent of Leapmotor—half the stake previously assumed. Earlier in the summer, the Chinese media outlet Cailian Press had reported that Leapmotor was seeking a 10 per cent investment, though those plans were still in the early stages at the time. Leapmotor’s largest single shareholder is the Stellantis Group, which acquired a multi-billion-euro stake in the company in 2023 and currently holds 21.26 per cent. Zhu Jiangming and other members of the founding team collectively hold approximately 25.8 per cent through ‘direct and indirect holdings,’ according to the portal Car News China. While the founders, together with Stellantis, do not hold a majority stake, they effectively retain control of the company. It remains unclear how much FAW would need to invest for the five per cent stake in Leapmotor—even though the figure now appears to be lower than previously anticipated. Leapmotor does not currently seem to be under significant financial pressure. In the third quarter, the company reported revenue of 19.45 billion yuan (2.36 billion euros), representing an increase of over 97 per cent compared to the same quarter last year and a 36.7 per cent rise from Q2 2025. For the coming year, Leapmotor’s Vice President Li Tengfei has projected a net profit of five billion yuan (currently around 610 million euros). On the other hand, pressure on the FAW Group is mounting to boost its comparatively weak electric vehicle sales. New Energy Vehicles (including battery-electric cars, plug-in hybrids, range-extender vehicles, and fuel cell models) currently account for only around ten percent of the group’s total sales, while the NEV share in the overall market stands at approximately 50 percent. FAW must close this gap and is hoping to gain technical insights and learning effects from Leapmotor, which exclusively offers battery-electric vehicles and range-extender models. (electrive.com)

-

Scelte strategiche BMW Group

BMW Group sets new climate target for 2035: At least 60 million tons of CO2e savings compared to 2019 – another milestone on the road to net zero Munich, 2 December 2025. The BMW Group has defined a new 2035 milestone for cutting CO2e emissions on the road to net zero. The company aims to reduce its CO2e emissions by at least 60 million metric tons compared to 2019 levels, an additional reduction of approximately 20 million tons of CO2e beyond the existing 2030 target. In doing so, the BMW Group is pursuing a comprehensive decarbonization strategy along the entire life cycle, with the goal of achieving net zero by 2050 at the latest. This represents a firm commitment to the goals set out in the Paris Agreement. To date, the target has been to cut at least 40 million metric tons of CO2e across the entire life cycle (scopes 1, 2 and 3) by 2030 compared to 2019 levels. The new 2035 milestone is a logical next step on this road toward advancing decarbonization. At the same time, the climate impact of the BMW Group’s business model will also be drastically reduced. By 2035, each euro generated will see less than half as much CO2e emitted compared to 2019. The key measures for achieving these results include the increasing use of renewable energies in production and the supply chain, the increased utilization of secondary raw materials, efficiency improvements in the use phase, as well as product and process innovations. The latter are being implemented across all drive variants as part of the BMW Group’s technology-neutral approach. In addition, an increasing proportion of the vehicle fleet will continue to be electrified. Decarbonization along the entire life cycle The BMW Group has intentionally set itself the additional 2035 milestone to consistently advance its decarbonization strategy. Global customer demand for electric vehicles alone will not be sufficient to achieve the CO2e targets set for 2030 and 2035. The comprehensive approach to reducing CO2e emissions therefore spans the entire vehicle life cycle, irrespective of the drive variant. In the supply chain, which is increasingly relevant in terms of CO2e emissions, especially for electric models, the company focuses on expanding the use of secondary raw materials and renewable energies. The specific priorities are highly CO2e-emitting components such as high-voltage batteries, aluminum, and steel. In addition, the company will be implementing product and process innovations, such as in the BMW Group’s sixth generation (Gen6) of battery technology. The BMW Group also applies high standards in production: for example, since 2020, all electricity sourced from external suppliers for all plants worldwide has come exclusively from renewable sources. The BMW Group also works continuously on replacing fossil fuels. The new iX3 plant in Debrecen, Hungary, is the BMW Group’s first car factory to produce vehicles without any fossil fuels such as oil and gas in standard operation. To lower CO2e emissions during the use phase, the BMW Group is implementing additional efficiency measures such as BMW EfficientDynamics, in addition to electrifying its vehicle fleet. As a result, efficiency potential in all vehicle subsystems, such as the drive system, tires, and aerodynamics, is consistently identified and implemented, regardless of the drive technology. The new BMW iX3, for instance, uses up to 20% less energy (WLTP combined) than its predecessor. Reaching the new milestone will also depend on a variety of external factors, such as the transformation of the steel industry in favor of more CO2e-reduced steel, the expansion of the charging infrastructure, progress in the circular economy, and the advancement of battery cell technologies. This is why the BMW Group continues to pursue a number of strategic initiatives, such as the ongoing expansion of in-house expertise in state-of-the-art battery cell centers of excellence and innovative circular economy projects. (BMW Group)

- Tecnologie per la sostenibilità ambientale e geopolitica dell'Elettrificazione

-

BMW Serie 3 2026 - Prj. G50 (Spy)

UKL non e piu in uso, tutti i FWD oggi sono FAAR e FAAR WE (Weiter_Entwicklung, quindi evoluzione) Le RWD sono su CLAR. in versione CLAR WE (G2x, vecchie Xx) e CLAR 2 (G60/70). NCAR e una archittetura completamente nuova e diversa bev-only, con la batteria come parte della struttura usabile come RWD, ma anche FWD come la prossima NB5. Una volte era pensato come piattaforma unica per tutto, ma con il probabile prolungamento della era dei ice/Phev al momento sono in considerazione diverse alternative come andare avanti. Per le Ice-RWD la soluzione e quasi fissato, per le FWD e completamente aperto, non ha priorita questo segmento. non conosco le dimensione esatte, ma secondo me G50 sara come oggi le G23/G26, quindi qualcosa tra 4,75 e 4,80, NA0 sara un po piu compatta.

- Scelte strategiche BMW Group

-

F1 2025 - Qatar 28-30/11

…..Forse avrebbe più senso sostituire Elkann e Vasseur…..😎

-

BMW i3 2026 - Prj. NA0 (Spy)

(AM&S)

- BMW Serie 3 2026 - Prj. G50 (Spy)

- BMW: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

-

BMW: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

Le eccezioni confermano la regola, ma il fatto è che qui nei distretti di immatricolazione di Starnberg e Monaco, i due con la più alta percentuale di cabriolet di tutta la Germania, quasi solo gli anziani guidano una cabriolet. Anche nella cerchia di amici non ci sono praticamente figli che guidano una cabriolet. L'unica eccezione è il figlio di un amico che guida una 240i Cabrio (anche se nella famiglia ci sono molte altre auto a disposizione in caso di necessità). Tutti gli altri guidano X1, X3, station wagon o, peggio ancora, furgoni per trasportare mountain bike e simili.

-

BMW: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

…..e in quale regione del mondo si potrebbero trovare questi appassionati? Il mercato delle auto decapotabile è completamente morto in tutto il mondo, tutti quelli che amano guidare all'aperto, i boomer e tutti gli altri anziani, hanno già almeno una cabriolet e non ne hanno bisogno di una nuova, mentre per le giovani generazioni guidare all'aperto è assolutamente fuori discussione.

- Lotus Eletre Hyper Hybrid 2026 (Spy)

-

Leapmotor B05 2025

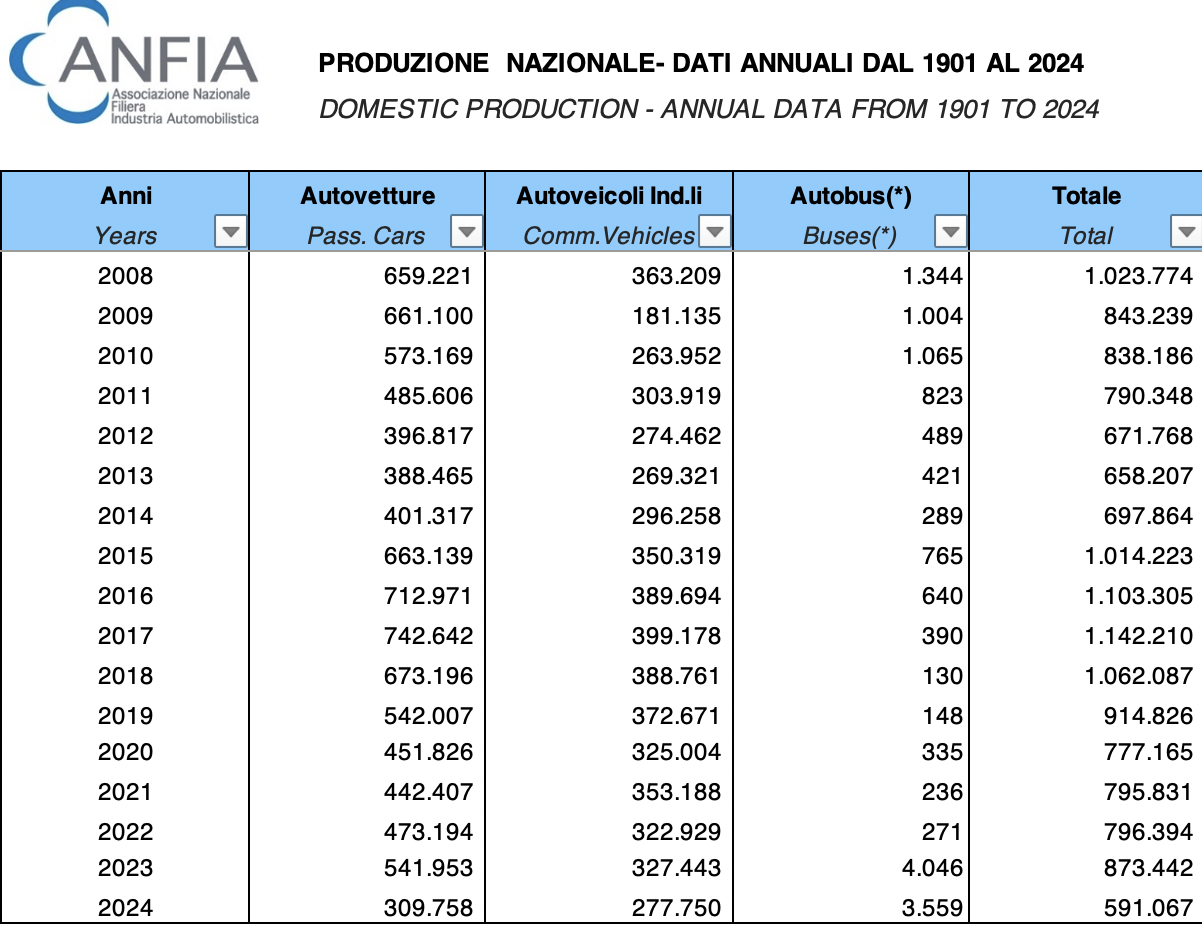

Prezzi B05 in Cina………. B05 is built on the LEAP 3.5 platform and measures 4,430 mm in length, 1,880 mm in width, and 1,520 mm in height, with a wheelbase of 2,735 mm. It is equipped with a rear-mounted electric motor available in two outputs, 132 kW or 160 kW, and paired with either a 56.2 kWh or 67.1 kWh battery pack. These correspond to CLTC-rated ranges of 515 km or 605 km. Upper trims add a roof-mounted LiDAR unit combined with a 200 TOPS computing platform supported by 27 perception sensors. The interior includes an 8.8-inch digital instrument cluster and a 14.6-inch 2.5K central touchscreen running Leapmotor OS 4.0 Plus on a Snapdragon-based cabin processor. Depending on the version selected, features may include ventilated and heated seats, a panoramic roof, 256-colour ambient lighting, wireless charging on the “magic expansion island” centre console, and upholstery ranging from fabric to Nappa leather or faux-suede. Exterior elements designed for a youthful audience include frameless doors, hidden door handles, a sealed front design, and a fastback roofline. Colour options include Electric Yellow, Starsky Blue, and Morgan Pink. Leapmotor has confirmed that a sport-oriented Lafa 5 Ultra will arrive in the second quarter of 2026 with a more aggressive exterior package and black 19-inch wheels. According to the company, “Lafa” represents Lifestyle, Attitude, Freedom and Art, distinguishing the model within Leapmotor’s lineup and marking the start of a new series planned for global release beginning in 2026. There is speculation that the B05 could be rebadged under a partner brand, such as Opel, which is also part of Stellantis, though this possibility has not been confirmed. (CNC)

-

Lotus Eletre Hyper Hybrid 2026 (Spy)

Lotus Eletre PHEV to debut in China in January 2026 – European launch in H2 next year The Lotus Eletre PHEV will debut in China in January 2026, the company’s CEO hinted. This model will start sales in the Middle Kingdom in the first quarter. In H1 2026, the plug-in hybrid Lotus Eletre will launch in Europe, following the brand’s strategic shift towards PHEVs. Lotus experienced a sales drop this year as its deliveries from January to September slid by 40%, according to the company’s unaudited Q3 report. In the first nine months of the year, Lotus sold 4,612 cars globally, with China occupying 46% of the share. Company officials shared that this drop represents a transitional period characterized by tariff impact, gradual destocking, and phased commencement of upgraded models deliveries. Lotus CEO Qingfeng Feng commented on the Q3 report, adding that the upcoming PHEV marks an important milestone in the company’s strategy. According to Autohome, Qingfeng Feng shared more information about the brand’s first plug-in hybrid vehicle during an earnings conference call on November 24, 2025. Lotus Eletre PHEV to debut in ChinaLotus CEO shared during an earnings conference call that the brand will add plug-in hybrid models to its existing lineup, with the first PHEV debuting in January 2026. It will officially enter the Chinese market in the first quarter, followed by the European launch in the second half of 2026. Qingfeng Feng didn’t share the name of this model. However, according to his description, it is an SUV. It was previously revealed that the Lotus-branded plug-in hybrids will share the same 900V high-voltage system and a mixed range of around 1,100 km. Bearing in mind that Lotus is a Geely-owned company, it will most likely adopt powertrain elements from Horse Powertrain. It is a joint venture between Geely, Renault, and Aramco. This company has recently started manufacturing the DHE20TDE 2-liter turbocharged engine dedicated to PHEV systems. It has a peak power of 205 kW (275 hp) and a thermal efficiency of 46%. Previously, the Zeekr 9Xbecame the first car to adopt this engine. Its top-trim level has three e-motors for 1,030 kW (1,381 hp). This large 5.2-meter SUV with three rows of seats speeds up to 100 km/h in 3.1 seconds. It is available with two battery options for 50 kWh and 70 kWh. (CNC)

- Audi A6 Avant & A6 Sedan 2025

- Audi A6 Avant & A6 Sedan 2025

-

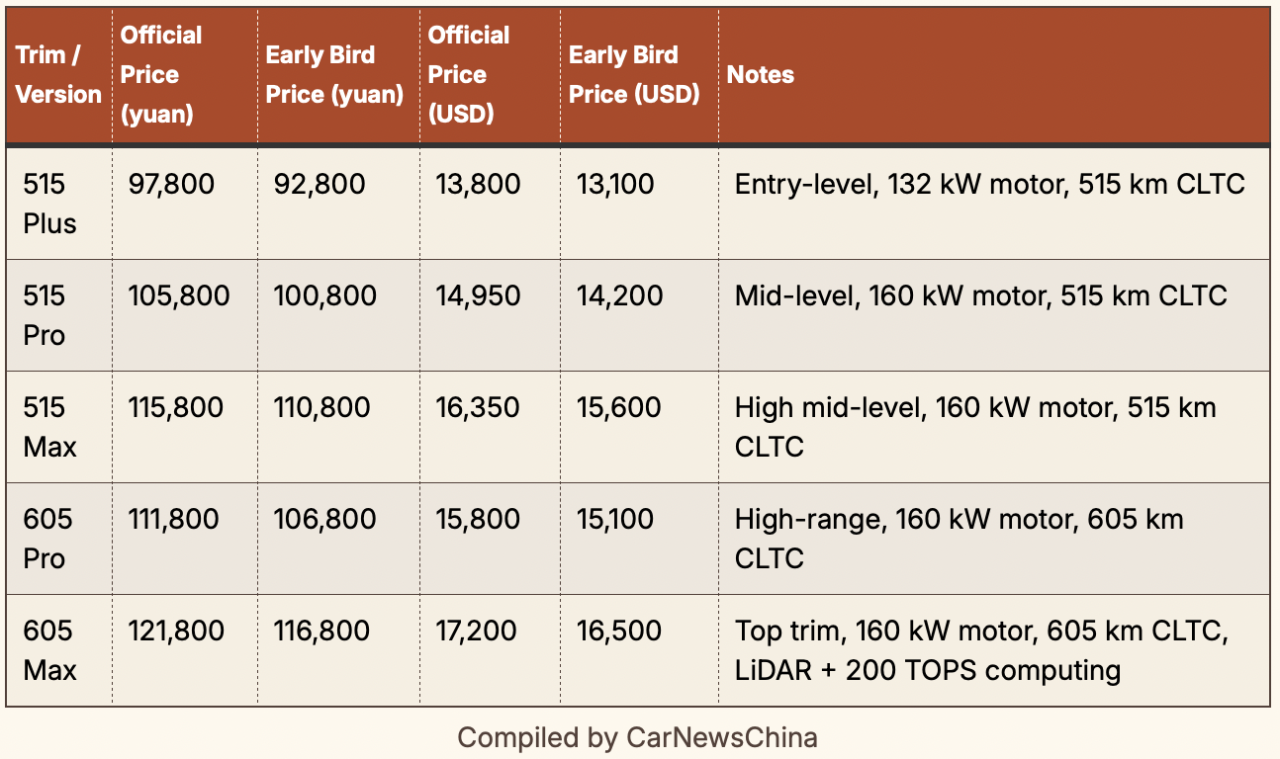

Scelte strategiche gruppo VAG

Nuova organizzazione del rete di produzione per regioni Wolfsburg. The Brand Group Core within the Volkswagen Group – the organizational unit including the volume brands Volkswagen, Škoda, SEAT&CUPRA and Volkswagen Commercial Vehicles – is strategically reorienting its production and establishing a high-performance regional production network. #Brands As a first step, André Kleb, to date Head of Planning and Production Technology of the Volkswagen brand, is to assume responsibility for the regional management of production and logistics as the Chief Production Officer for the Iberian Peninsula with effect from January 1, 2026. In the spirit of overall cross-brand responsibility, this newly created function will report to Christian Vollmer, Member of the Board of Management for Production & Logistics of the Volkswagen brand and member of the extended Group Executive Board, and also to Markus Haupt, CEO SEAT&CUPRA. The new structure for the Iberian Peninsula will include all the plants of the Volkswagen Group in Spain and Portugal. Overarching functions such as central planning, production steering, project and start-of-production management as well as logistics will be anchored within the regional management. In connection with the reorganization, Thomas Hegel Gunther, currently Managing Director and plant manager of Volkswagen Autoeuropa, is to succeed André Kleb as new Head of Planning and Production Technology of the Volkswagen Passenger Cars brand in Wolfsburg. Anabel Andión Lomero, to date the Head of the Pre-Series Center at SEAT&CUPRA in Spain, will become Managing Director and plant manager of Volkswagen Autoeuropa in Portugal with effect from March 1, 2026. This new team is also to include Anabel Andión Lomero as the future Managing Director of Volkswagen Autoeuropa. She played a key role in the establishment of the Vorseriencenter (VSC) at SEAT&CUPRA, which is the starting point for the start of production of the Electric Urban Car Family. She will contribute her specialist expertise from the overarching VSC and from past cooperation projects to the Palmela plant in the future. Under the management of Thomas Hegel Gunther, the Palmela plant has been transformed into one of the most efficient production locations of the Volkswagen brand over the past few years. Christian Vollmer: “Following the successful start of production of the new T-Roc, now is the right time to benefit from Thomas Hegel Gunther’s expertise for the introduction of efficient production structures. He will therefore play a key role as the new Head of Planning and Production Technology.” Improved competitiveness and efficiency in automobile production The new BGC Future Production Governance management model with 22 locations is characterized by lean processes in the plants supported by high-performance central functions. Within this system, the regions will become more independent, more efficient and more flexible. The objective is to ensure a sustained long-term improvement in the competitiveness of BGC-automobile production with cross-brand steering and regional responsibility to master the future challenges. The production and logistics business area will be setting new standards within the Volkswagen Group and the industry. Biographic details André Kleb joined Volkswagen after completing his degree in mechanical engineering at the Technical University of Brunswick. Thanks to his many years of experience in international start-of-production and project management, he is extremely well networked at the plants. He has worked in various responsible management functions within production in Germany and other countries, including positions as Head of Plant Planning at Pamplona, Spain, and Wolfsburg. Since 2021, he has been Head of Vehicle Project Management, Planning and Production Technology of the Volkswagen Passenger Cars brand. Anabel Andión Lomero joined the test production department of SEAT&CUPRA in 2001. From 2005 to 2008, she was responsible for order management at the prototype center of SEAT&CUPRA and then managed various projects at the prototype center and in start-of-production management at Martorell up to 2012. In 2018 she was appointed as Head of Digital Production at the Pre-Series Center of AUDI AG in Ingolstadt. Since 2020, she has been Head of the Vorseriencenter at SEAT&CUPRA. Thomas Hegel Gunther joined Volkswagen AG as an international trainee in 2000. From 2001 to 2004, he worked in the body shop at Wolfsburg. In 2005, he was appointed Assistant to the Board Member, Components. From 2007 to 2013, he worked in various management positions in the Components business area. In 2013, he became Head of the Plastics Business Unit. In 2015, he was appointed Chairman of the Board of Management of SITECH Sp. z o.o. in Polkowice (Poland) and Speaker of the Management Board of SITECH Sitztechnik GmbH. In 2018, he became Head of Production Control and Logistics of the Volkswagen Brand. He has been Managing Director of Volkswagen Autoeuropa in Portugal since 2021. (VW-Group)

- 1568 risposte

-

- audi

- cupra

- ducati

- lamborghini

-

Taggato come:

-

Porsche Cayenne Electric 2026

-

Fiat 500 Hybrid 2025

Le vendite annuali sono state distribuite in modo molto diseguale nel corso degli tanti anni: tra il 2015 e il 2019 si sono sempre attestate tra le 25.000 e le 30.000 unità all’anno (erano il picco), ma dopo il Covid hanno subito un forte calo, probabilmente anche a causa dei prezzi. Negli anni precedenti al Covid, la 500 era venduta in Germania a prezzi molto convenienti, spesso come reimportazione. Se la nuova versione a combustione raggiungerà le 10.000 unità all'anno, penso che sarà già un grande successo. Il prezzo elevato, i consumi elevati e il calo di appeal del concetto retrò renderanno difficile guadagnare terreno in questa classe rispetto ai modelli più moderni, in particolare la i10.

- Fiat 500 Hybrid 2025

- I prossimi modelli BMW