Tutti i contenuti di 4200blu

- Scelte strategiche Daimler

- Mercedes‑AMG GT 4‑Door Coupé 2026 (Spy)

- BMW Serie 3 2026 - Prj. G50 (Spy)

- BMW Serie 3 2026 - Prj. G50 (Spy)

-

BMW i3 2026 - Prj. NA0 (Spy)

-

Audi Concept C 2025

L'auto elettrica Concept C arriverà tra due anni Il CEO di Audi Gernot Döllner lo rende ora ufficiale: la produzione della versione di serie della Concept C, che probabilmente si chiamerà “C-Sport”, inizierà tra due anni. Audi non si scompone di fronte alla possibile uscita di Porsche dal progetto di sviluppo congiunto. Il CEO di Audi, Gernot Döllner, ha ora confermato ufficialmente la futura produzione in serie della Concept-C. La produzione del modello, denominato da alcuni media C-Sport, dovrebbe iniziare tra due anni. Döllner lo annuncia così pubblicamente, dopo aver già incoraggiato i propri dipendenti a metà febbraio con una lettera interna. (AM&S)

- I prossimi modelli Maserati

-

Maserati - Filosofia sul brand, sui modelli e sullo sviluppo

Anch'io sono cliente Maserati da quasi 30 anni, ma non mi verrebbe mai in mente di acquistare un SUV Maserati, mentre una berlina sì.

- 604 risposte

-

-

- 1

-

-

- 2.0 mhev

- 2.0 phev

- folgore

- future maserati

-

Taggato come:

- 2.0 mhev

- 2.0 phev

- folgore

- future maserati

- ghibli mca

- grecale

- levante m184

- levante mca

- m156

- m157

- m161

- m183

- m184

- m189

- m240

- m6u

- m9s

- maserati

- maserati 100% electric

- maserati bev

- maserati d-uv

- maserati elettrica

- maserati ev

- maserati f-uv

- maserati full electric

- maserati grecale

- maserati mc20

- maserati newgt

- maserati spy

- maserati supercar

- mmxx

- mmxxi

- new v6

- nuove maserati

- nuovi modelli

- quattroporte m183

- quattroporte mca

-

I prossimi modelli Maserati

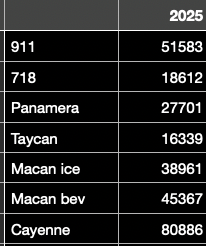

Le vendite della Panamera non sono poi così scarse, considerando la fascia di prezzo in cui dovrebbe collocarsi anche una 4P (Porsche Media) Auto come la MC20/Pura non sono alternative alla 911, un'auto sportiva per ogni occasione. Sono auto che nel primo anno, quando sono nuove, vengono acquistate da fanfarone e poi nessuno le vuole più e non corrispondono minimamente al DNA Maserati

- I prossimi modelli Maserati

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

-

Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

Si e cosi che il cost of owner ship e cosi importante, perche tutti scelgono Phev e non bev che costerebbe ancora meno? Contafogli non in grado di calcolare? Se davvero tutti la pensassero/ragionassero come dici tu, allora tutte le X5 vendute in Italia, per fare un esempio concreto, dovrebbero essere Phev, perché tutte le X5 sono auto aziendali. Ma non è così.- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

Secondo te, le auto aziendali esistono solo nelle grande flotte della Telecom ecc.? Che dire degli studi legali, dei grandi studi di architettura, delle medie imprese IT, di tutte le piccole aziende siderurgiche della Lombardia, delle case di moda ecc. ecc. Lì non è solo il capo ad avere un'auto aziendale, ma anche molti dei soci e dei dipendenti. E tutti dovrebbero essere costretti a guidare un PHEV? Onestamente non riesco a immaginarlo, lì la maggior parte delle persone sceglie l'auto aziendale che preferisce, pur rimanendo entro certi limiti finanziari, ma in modo autonomo.- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

oppure da Y e Gamma 😂. Quanti Y premium sono venduti in Europa fuori Italia fino ad oggi? 1000, 1500? E chi fuori Italia in Olandia, Belgio, Austria, Germania comprera una Gamma premium con lo stesso motore misero come Frontera o C3 Cross ?? Se uno accetta una macchina cosi, poi prende Frontera, costa la meta o 2/3 della Lancia e ha un rete di servizio capillare.- Audi RS 5 & RS 5 Avant 2026

Secondo me il contrario e giusto, tutti questi componenti complicate mecchanicci sono overengineering, un motore elettrico e un po di software per controllare non costa tanto, eha meno fonti per difetti e si piu aggiornare tramite versione software.- Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo

Ma poi il punto di partenza e sbagliato. Non si divetera premium con un seg B e un seg C+ con ka stessa base tecnica che si puo comprare anche con modelli low cost del gruppozzo. Premium inizia sempre sopra e poi, fatto bene, difonde piu giu. Genesis e Lexus hanno iniziato con modelli V8 e V6 segmento E e F, non con una Lexus Yaris oppure una Genesis Ceed.- BMW M5 & M5 Touring LCI 2027 - Prj. G90/G99 LCI (Spy)

Ti è mai capitato di sederti in una NA5? Allora puoi rispondere tu stesso alla domanda 😎 I tempi delle F1x e F3x sono storia passata.- Audi RS 5 & RS 5 Avant 2026

Ora è davvero una domanda, perché non lo so: forse meno peso o una regolazione più precisa dell’intervento oppure trasferibilità di momenti più elevati? Oppure tipico per i tempi di oggi - meno caro? - Lancia: filosofia sulla storia, sul brand, sui modelli e sullo sviluppo