Tutti i contenuti di 4200blu

-

Tecnologie per la sostenibilità ambientale e geopolitica dell'Elettrificazione

Germania oggi - ricaricare a casa (in Germania a ca. 35ct/kW) solo per quelli che vivono in villette e case independente…. "Dove si ricarica oggi Uno sguardo alla realtà mostra un netto squilibrio. “L'80-85% delle ricariche avviene in ambito non pubblico”, afferma Conrad Hammer (Centro nazionale di coordinamento per le infrastrutture di ricarica), soprattutto nelle abitazioni private, ma anche sul posto di lavoro. Tuttavia, nei condomini solo il 14% circa delle ricariche private viene effettuato finora. Particolarmente drammatico: negli edifici con più di dieci unità abitative, la percentuale di appartamenti con un proprio punto di ricarica è appena dell'1%. Il potenziale è enorme, perché in Germania ci sono circa 21 milioni di appartamenti in condomini e circa nove milioni di posti auto associati." (Electrive / Deepl)

-

BMW i3 2026 - Prj. NA0 (Spy)

Ancora più importante del primo NA0 in fabbrica è sicuramente il fatto che la linea di assemblaggio completamente nuova, realizzata negli ultimi due anni durante il normale funzionamento dello stabilimento, funziona e opera come pianificata in modo completamente virtuale tramite il digital twin. Questo capolavoro fa parte della promozione di Nedeljkovic da T ad A.

-

Jaguar 4-doors GT BEV 2027 (Spy)

Si, ma questo sviluppo non e un interruttore che si può semplicemente premere, e un sviluppo continuamente e per un brand di nicchia come Jaguar che si ridefinisce completamente (macchine tra 150 e 250k €, non piu tra 80 e 150 come prima) potrebbe essere decisamente più efficace (considerando i costi di sviluppo e produzione in caso di doppio binario) di vendere solo 10.000 unita bev al anno rispetto 20000 bev+ice.

-

Scelte Strategiche Gruppo Geely

Geely will use Ford factory in Europe to produce vehicles in the region Geely will use Ford factory space in Europe to produce vehicles for the region, Reuters reported. In exchange, Geely will give Ford access to its assisted driving technologies. The two parties have a major goal of cutting manufacturing costs. According to people familiar with the matter, Geely and Ford had a high-level meeting in Michigan last week. Recently, the American automaker sent a delegation to China, aiming to intensify discussion. However, it is reported that talks between the two parties have been underway for months. Ford and Geely officials haven’t shared any concrete information about their cooperation. It is unknown which Ford plant is in the middle of the discussion. Last year, Ford released a statement that its facility in Cologne (Germany) would switch production to single-shift operation from January 2026. Ford also has plants in Saarlouis (Germany) and Valencia (Spain). The utilization of Ford’s European factory space will allow Geely to avoid anti-subsidy tariffs imposed on China-made electric cars by the European Union. Geely Group currently suffers from an additional 18.8% tariff on top of the standard 10%. It was previously reported that tariffs will be replaced with a minimum import price in the EU. However, the tariffs are still in force at the time. What will Ford getIn return, Geely will provide Ford with assisted driving tech. Geely Group owns the ADAS system developer Afari Technology (Qianli Technology) that has recently released the new G-ASD assisted driving system. It utilizes the World Action Model (WAM). The company’s officials shared that it is a world behavior model with self-reflection and evolution capabilities. The cars with G-ASD can perform actions in powertrain control, chassis & driveline control, body & electronic control, and cockpit control areas. It allows the car to autonomously navigate through underground parking garages across floors and roundabouts, or recognize highway gates & parking lot gates. The G-ASD system was already adopted by Lynk & Co and Zeekr cars. (CNC)

-

Alfa Romeo - filosofia sul brand, sui modelli e sullo sviluppo

Questa domanda da sola la dice lunga sulla conoscenza dell'omologazione di un'auto.

-

Alfa Romeo - filosofia sul brand, sui modelli e sullo sviluppo

Esatto.

-

Tecnologie per la sostenibilità ambientale e geopolitica dell'Elettrificazione

BYD’s next-gen megawatt charger leaks: 1,500 kW vs. 1,000 kW first gen Leaked nameplate information and recent Chinese online reports indicate that BYD’s second-generation megawatt flash charging system could support up to 1,500 kW and 1,500 A. This represents a 1.5-times increase over the first-generation system introduced in 2025. Technical specifications cited in forums and news posts indicate a maximum DC voltage of 1,000 V and an input capacity of 2,100 kW to support grid management. The parameters suggest a potential reduction in charging time for high-voltage electric vehicles and higher support for fast-charging battery packs and drivetrain architectures. According to a Chinese tech blogger, the second-generation stations have been partially revealed online. These unofficial reports indicate a peak power of up to 1,360 kW, supporting 10C+ charging, with an estimated five-minute range gain of approximately 400 km. The stations are reportedly compatible with BYD Han, Tang, and other flagship models. The blog also describes a T-shaped dual-gun design with a 1.5 m² footprint, 2 kg liquid-cooled cables, and intelligent power distribution. Single-station energy storage has reportedly doubled compared with the first generation, enabling more than 20 vehicles to charge consecutively. BYD introduced its first-generation megawatt flash charging system at a product launch on March 17, 2025. That system was integrated with a high-voltage electric platform and was disclosed to support a charging current of 1,000 amperes, a peak charging power of 1,000 kilowatts, and a battery pack charging capability of up to 10C. The first-generation system could add approximately 400 kilometers of driving range in five minutes under test conditions. The unofficial reports indicate that second-generation stations support a 500–1000 V wide-voltage platform. Existing first-generation stations can reportedly be upgraded to 500 kW ultra-fast charging via dual-gun and intelligent-boost modifications. A “youth version” of stations with 200–600 kW of power is also said to be in development to accommodate a wider range of vehicles. As of late 2025, BYD had deployed over 500 megawatt-class charging stations across more than 200 cities in China. The company plans to expand the network further in 2026. A three-tier network layout comprising flagship, satellite, and community stations is reportedly planned. Partnerships with Xiaoju Charging and Xindiantu aim to support the construction of more than 15,000 stations by 2026. The leaked nameplate and forum reports suggest that the second-generation system increases electrical limits relative to the first generation. The charger is reportedly designed with IP55 protection and measures to mitigate impacts on the transformer and the grid. An official BYD confirmation has not been issued, and vehicle model applications, battery chemistry updates, and deployment timelines for the 1,500 kW system remain unverified. Ultra-high-power charging is increasingly competitive in China’s electric vehicle market. Tesla’s V4 fast-charging system reaches about 500 kilowatts, Li Auto’s system around 520 kilowatts, Nio’s system approximately 640 kilowatts, and Xpeng’s system around 800 kilowatts. Zeekr has disclosed a 1.2-megawatt charging station, while Huawei and Didi have announced megawatt-class charging solutions. These developments reflect a broader industry push toward ultra-fast charging and high-voltage electric platforms. Chinese manufacturers continue to expand charging infrastructure alongside vehicle development. BYD’s 1000 kW megawatt flash chargershave been integrated into the company’s Super e‑Platform vehicles. Deployment is being scaled nationwide, and international expansion is underway. Other automakers, including Li Auto, Xpeng, and Zeekr, are also increasing ultra-fast charging station construction across China. The leaked specifications define BYD’s second-generation megawatt flash charging system with a maximum current of 1,500 amperes and a maximum power of 1,500 kilowatts. The technical details reported on social media and blogs are unofficial and unconfirmed. (CNC)

-

Porsche 718 Cayman e Boxster 2027 (Spy)

Se la 718 bev verrà fermata, la conseguenza sarà che, almeno nel medio termine, non ci sarà più alcuna 718, perché se già l'estensione della 718 bev a una variante phev non è più finanziabile per Porsche, tanto meno lo è uno sviluppo completamente nuovo. Non hanno piu i soldi per modelli di nicchia e piccolo profitto. Con il crollo del mercato cinese non c’e piu la cash cow piu importante.

-

Jaguar 4-doors GT BEV 2027 (Spy)

Ma le due Porsche sono SUV, in particolare la M1 è una classe di veicoli completamente diversa dalla prossima Jaguar, che è una berlina di lusso, mentre la M1 è una Wannabee-Porsche per semi-poveri che non possono permettersi un'auto di lusso.

-

Jaguar 4-doors GT BEV 2027 (Spy)

Sicuro? La settimana scorsa nella albergo nelle Dolomiti era un ospite di Slovenia con e-tron GT RS. E la Slovenia non è certo un esempio paradigmatico di infrastrutture futuristiche per il bev.

-

La pericolosità delle portiere ad apertura elettronica

500N benchmark set: China mandates new safety standard requiring mechanical emergency release China has approved a mandatory national standard for vehicle door handles (GB 48001‑2026), effective January 1, 2027. The rules require all passenger cars and light commercial vehicles to feature mechanically releasable handles that can open under emergency conditions, including electronic system failures and crash scenarios. The standard applies to these vehicle types, with other categories encouraged to adopt the specifications, according to Autohome. The standard addresses safety concerns related to exterior door handle operation, particularly the inability to open doors after certain incidents, as CarNewsChina previously reported. Each door, excluding the rear hatch, must have a mechanically releasable exterior handle. Handles must be located within designated shadow areas on the door surface or adjacent door frame and provide sufficient hand-operating space in all states to permit effective mechanical release during emergencies such as irreversible restraint system deployment or battery thermal events. Exterior handles, including electrically actuated systems, must meet uniform performance criteria. Vehicles with electric release mechanisms must include independent mechanical linkages capable of withstanding forces of at least 500 N without breaking or detaching. After testing, handles must still be able to open the corresponding door to ensure reliable emergency operation. Interior door handles are also subject to mechanical reliability requirements. Each side door must have at least one mechanical release handle, and any interior handle must independently open its corresponding door. The standard defines precise installation zones for at least one interior handle, requiring unobstructed visibility from the occupant position, placement within 300 mm of the door edge, and vertical alignment relative to the seating reference point. The regulation also sets requirements for identification and usability. Interior handles must feature permanent, unobstructed graphical symbols of at least 100 mm × 70 mm with high contrast, and Chinese or pictorial operation instructions must be provided nearby with a minimum character height of 6 mm. Technical performance testing must confirm that rotational interior handles withstand at least 300 N and button-type handles at least 500 N without structural failure, and all handles must open the door after testing. Phased implementation is specified in the standard. Vehicles applying for new type approvals must meet most requirements from July 1, 2025, and all requirements after 13 months. Vehicles with existing type approval must comply with all requirements by July 1, 2027, following a 25-month transition period. GB 48001‑2026 provides a unified framework for vehicle manufacturers and component suppliers to ensure mechanical reliability, emergency operability, and consistent safety performance across passenger cars and light commercial vehicles. (CNC)

-

Alfa Romeo - filosofia sul brand, sui modelli e sullo sviluppo

Con un gancio di traino non solo è possibile trainare una roulotte, ma anche trasportare un motoscafo dal rimessaggio invernale al posto di ormeggio. Oppure, molto più spesso, mountain bike (nel mio caso una Lombardo Tures DC90 e una Tures Race di mia moglie più un portabici Thule Easy Fold 3, 25,9 kg + 26,1 kg + 18,5 kg, per un totale di 70,5 kg, ben oltre il limite della Giullia di 64 kg). Con un'Audi con limite di 80 kg o una Serie 3 con limite di 75 kg, invece, non c'è alcun problema. Anche il carico sul tetto di soli 50 kg della Giulia (contro i 90 kg dell'Audi e i 75 kg della BMW) non è proprio indice di una struttura della carrozzeria eccessivamente stabile e non è di grande aiuto per una vacanza sulla neve con 3 o 4 persone.

- Scelte strategiche BMW Group

-

Alfa Romeo - filosofia sul brand, sui modelli e sullo sviluppo

Lo svantaggio della struttura leggera della Giulia è la scarsa stabilità, che si nota dalla capacità di traino inferiore alla media e dal carico di appoggio ridotto con gancio di traino. Quest'ultimo non è sufficiente nemmeno per due mountain bike elettriche con relativo portabici.

- Scelte strategiche BMW Group

-

Scelte strategiche BMW Group

ZF and BMW Sign Agreement for Future-Oriented Drive Technologies • Further development of the 8-speed automatic transmission with a special focus on electrified drives • Strengthens technological flexibility, provides planning stability Friedrichshafen, Munich. ZF Friedrichshafen AG and the BMW Group have signed a long-term supply agreement in the field of passenger car drive systems. The core of the agreement is the supply and continued development of the proven 8-speed automatic transmission (8HP). The contract, worth several billion euros, runs until the late 2030s. This creates a solid foundation for open-technology and low-emission mobility of the future for both companies. “Together with BMW, we are sending a strong signal for innovation, efficiency, and sustainability in an industry undergoing dynamic change,” says Mathias Miedreich, CEO of ZF. “This agreement highlights the strategic importance of our 8-speed automatic transmission as a key technology for the transformation of drive systems.” As part of the partnership, the 8HP transmission kit will be continuously developed. The aim is to provide customers with the most powerful and efficient transmission that meets the requirements of future drive concepts. “The new agreement with BMW shows how important long-term planning horizons are for technological advancements,” explains Sebastian Schmitt, Head of ZF's Electrified Drive Technologies division. “It creates clarity and stability for both companies and enables us to align the next generation of the 8HP specifically toward efficiency, performance, and long-term viability.” ZF thus strengthens its position as a system supplier and gains additional planning reliability. Close collaboration in the future will help reduce risks in a rapidly changing market environment and lay the foundation for low emission mobility going forward. (ZF Group) Quindi almeno per la esportazione verso mercati non europei ci saranno Bmw Ice anche dopo 2035, altrimenti non avrebbe senso un contratto lungo oltre 10 anni. Sempr a condizione che ZF non fallisca prima.

-

Alfa Romeo - filosofia sul brand, sui modelli e sullo sviluppo

Ma stai confrontando mele e pere, ovvero un'auto concettualmente vecchia di oltre 10 anni con una attuale. Una Giulia III, quando finalmente sarà pronta nel 2029, sarà anche notevolmente più pesante rispetto una Giulia II di 15 anni fa, che a sua volta è notevolmente più pesante di una Giulia I.

- Audi RS5 & RS5 Avant 2026 - Prj. B10 (Leak)

- Audi RS5 & RS5 Avant 2026 - Prj. B10 (Leak)

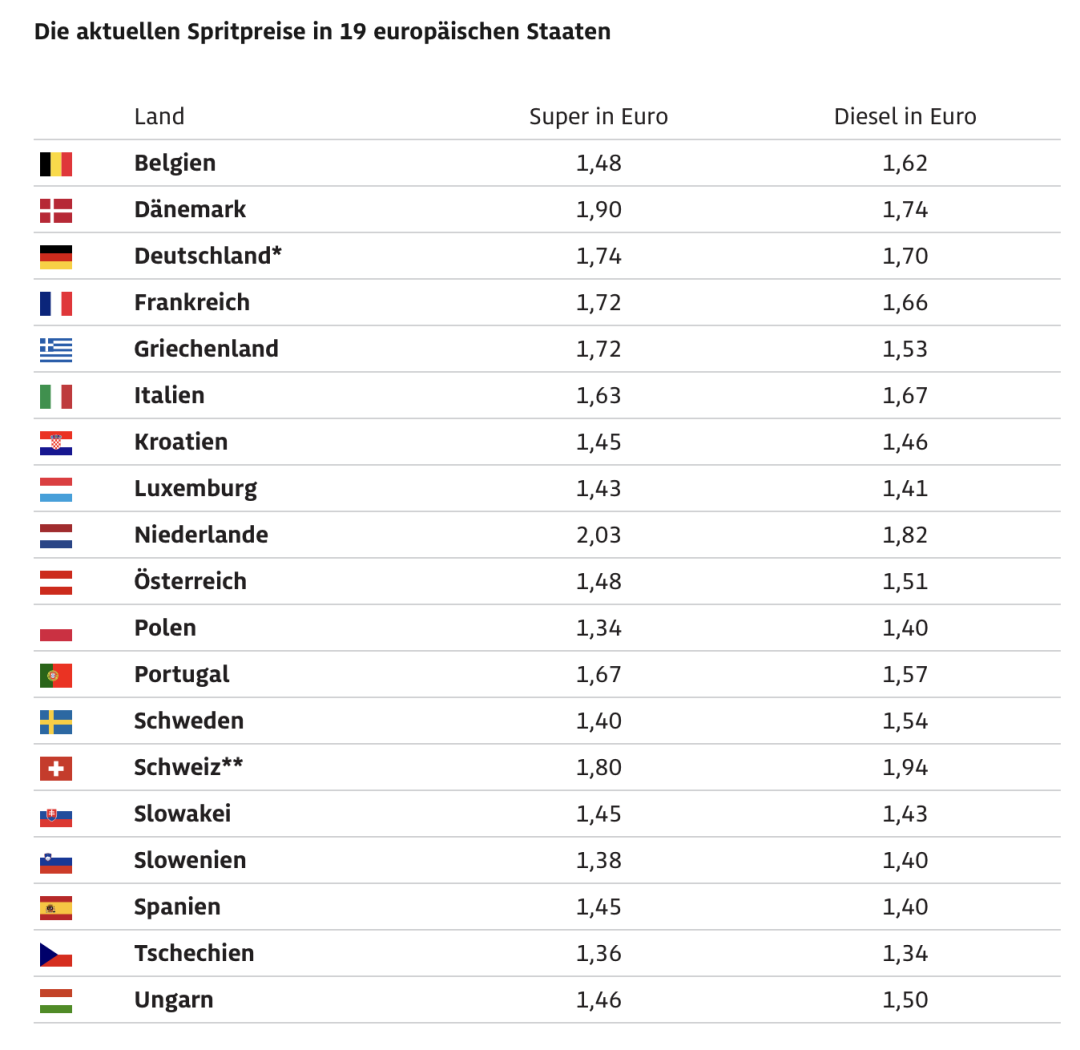

- Andamento prezzo Carburanti

-

Novità Batterie Stato Solido e Semi-solido

A breakthough in solid-state battery materials: Chinese researchers unveil “breathable” silicon anode A collaborative research team led by Professor Chen Wanghua from the Faculty of Physical Science and Technology at Ningbo University, alongside researchers from Ningbo University of Technology and Ningbo Institute of Technology, has announced a breakthrough in solid-state lithium battery anode materials. According to Chinese media Global Times,the team has successfully developed a novel silicon nanowire anode featuring a three-dimensional “breathable” structure, inspired by natural respiratory mechanisms, offering a promising new pathway for the development of high-performance silicon anode all-solid-state lithium batteries. The findings were recently published in the international energy materials journal, Energy Storage Materials. All-solid-state lithium batteries are widely regarded by scientists and industry as the “ultimate goal” for next-generation battery technology due to their enhanced safety, higher energy density, and superior cycle performance. Among potential anode materials for these advanced batteries, silicon stands out for its exceptionally high theoretical capacity—ten times that of traditional commercial graphite anodes—and excellent chemical compatibility. However, silicon’s practical application has been severely limited by its dramatic volume expansion, exceeding three times its original size during charge and discharge cycles. This expansion leads to severe mechanical stress, interface detachment, and rapid degradation of electrochemical performance. “If we liken a lithium battery to an energy storage warehouse, silicon is the recognized ‘super porter’ with immense storage potential,” explained Professor Chen Wanghua. “However, this ‘giant’ has an extremely volatile temperament: when absorbing lithium ions during charging, silicon’s volume violently expands by over three times. With repeated charge-discharge cycles, silicon acts like a balloon constantly inflating and deflating, eventually ‘collapsing’ due to exhaustion, leading to a sudden death of the battery’s lifespan.” To address this critical challenge, the research team devised an innovative solution to enable silicon to “breathe freely” within a rigid solid-state environment. Utilizing plasma-enhanced chemical vapor deposition (PECVD) technology, they designed and fabricated a novel three-dimensional columnar silicon architecture that integrates directly with the current collector. This design boasts a “dual-phase” core-shell structure, prepared through a two-step PECVD process. “We moved away from traditional ‘silicon powder’ and instead made silicon ‘stand’ like trees in a forest, interwoven to form a three-dimensional network on the current collector,” Professor Chen elaborated. “These nanowires have abundant voids between them, much like installing countless ‘breathing valves’ inside the battery. When lithium ions surge in, the silicon nanowires can expand into these reserved spaces without crushing the surrounding electrolyte.” Experimental results demonstrate that this columnar silicon anode exhibits exceptional electrochemical performance and practicality. The developed battery proved capable of continuously supplying power even when bent or cut with scissors, showcasing remarkable mechanical robustness and safety. This research establishes a new paradigm for unifying ion transport kinetics with mechanical integrity through architectural design. It provides a feasible and practical technical path for the development of high-energy, long-life all-solid-state silicon-based lithium batteries, bringing the next generation of battery technology closer to reality. (CNC)

-

BMW M2 M.Y. 2026

-

[CHN] Xiaomi SC-01 2024 (Spy)

The XiaoPaoChe SC-01 sports car was spotted in China during road tests. It is a small all-electric roadster from the startup that received huge investments from Xiaomi. The SC-01 has the body length of 4 meters, two seats inside, 435 hp and up to 500 km of range. We will briefly remind you that the SC-01 is a two-door electric roadster with dimensions of 4085/1820/1162 mm and a wheelbase of 2500 mm. For clarity, the SC-01 is 239 mm shorter, 44 mm narrower and 142 mm lower than the BMW Z4. The curb weight of the SC-01 reaches 1,300 kg. Moreover, it is powered with two electric motors for 435 hp. As a result, its zero-to-hundred acceleration time is 3.9 seconds. As for the battery of this roadster, its capacity has yet to be revealed. However, the range of the SC-01 reaches 500 km. According to previous information, the XiaoPaoChe’s first model won’t cost more than 300,000 yuan (41,260 USD).

-

Scelte strategiche gruppo Stellantis NV

- Scelte strategiche Ferrari

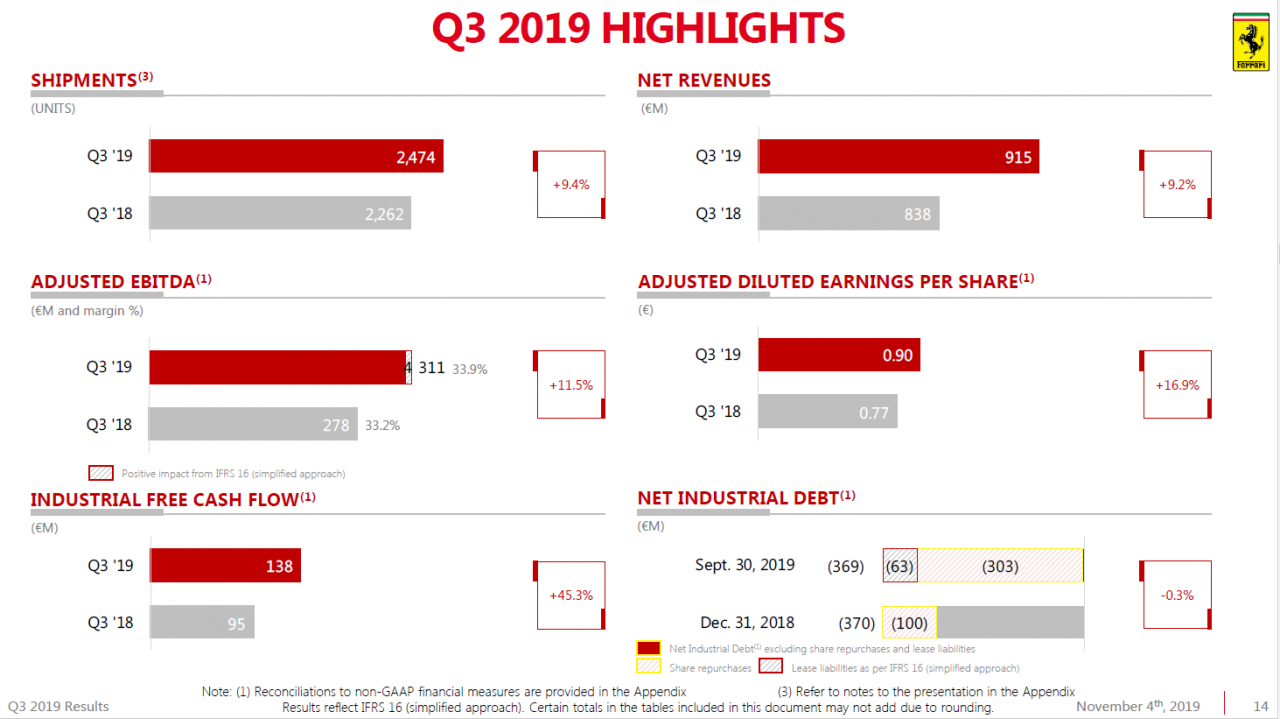

Lunedì 4 novembre 2019 sono stati presentati i risultati Q3 2019 del brand Ferrari. Viene inoltre confermata la presentazione del 5 modello previsto per il 2019 in data 14 novembre. Per quanto riguarda la gestione del brand, si sta ponendo l’accento anche su ciò che riguarda la valorizzazione del marchio al di fuori della produzione di auto: in primavera Ferrari ha lanciato la piattaforma Ferrari eSports creando dei campionati virtuali per gli e-racers, e nella prima metà del 2020 inizierà un campionato monomarca per tale piattaforma con eventi live durante le gare reali su pista, in musei o nei parchi tematici Ferrari. Parchi tematici che verranno ampliati. Si lavorerà poi sulle licenze di fabbricazione di prodotti a marchio Ferrari, riducendole del 50%, e puntando soprattutto sull’abbigliamento. In tal senso è stato siglato un accordo di produzione con la Giorgio Armani con lo scopo di elevare gli standard e la qualità dell’offerta in un ottica di diversificazione che punta al lusso. Sempre per sottolineare quest’ottica i 50 store ufficiali saranno rinnovati e si valorizzera anche il canale di e-commerce. Ed inoltre ci sarà l’apertura di due progetti: Manifattura Ferrari, dove verranno creati oggetti di artigianato unici dedicati ai clienti, ed Esperienza Maranello all’interno del quale prenderà vita un ristorante stellato che nascerà in collaborazione dello star chef Massimo Bottura. Ferrari conta nel corso dei prossimi di anni che questo programma di diversificazione arrivi a partecipare agli utili per una quota pari al 10%. - Scelte strategiche Ferrari

![Alfa Romeo Hug [Trolling Mode]](https://www.autopareri.com/uploads/reactions/Alfaromeocare.png.50be1dd8d7c15ba4fec8098a15bfa18a.png)