-

Numero contenuti pubblicati

14093 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

65

Tipo di contenuto

Forum

Galleria

Calendario

Download

Articoli del sito

Store

Blog

Tutti i contenuti di 4200blu

-

I prezzi per entrambi (Cayenne e GC) sono simile in Germania GC Limited 79.500.- / Summit Reserve 99.900.- Cayenne e-hybrid LCI - 103.300.-

- 394 risposte

-

- trailhawk

- grand cherokee 2022

- (e 8 altri in più)

-

...la giu...hanno gia sentito una volta di strumenti moderni - come per esempio orari flessibili, conto dell'orario lavoro che si accumula e si riduce dipende dalla richiesta del mercato?? .......

- 5216 risposte

-

- 1.5 mhev

- alfa romeo ufficiale

-

(e 4 altri in più)

Taggato come:

-

STOCKHOLM -- Sweden's Northvolt said it will invest several billion euros to build an electric-vehicle battery cell plant in Germany, after speculation that the company could divert planned investment to the United States. Northvolt said it is set to pick Heide in northern Germany for its factory as long as subsidies are approved. Spokespeople for Northvolt and the German government said the precise investment and funding amounts were not finalized and were subject to approval from the European Commission. Northvolt could invest around 3-5 billion euros ($8.81 billion) in the plant and receive around half a billion euros in German subsidies, according to two sources familiar with the matter. The battery maker, alongside Volkswagen, is the furthest ahead among just a handful of European players paving the way for a home-grown battery industry. Currently a large chunk of planned battery cell capacity in Europe is planned by Asian companies. In a further win for Europe, Taiwan's ProLogium said on Friday it had picked France for its first overseas battery plant. The subsidies for Northvolt's battery plant, if approved, would be the first granted by Germany under the European Union's Temporary Crisis and Transition Framework, developed to support green industrial projects as Europe scrambled to provide a competitive offer to U.S. subsidies provided by the Inflation Reduction Act. "The EU-Commission opened up a clear path towards securing important industrial investments in Europe," German Economy Minister Robert Habeck said in a statement. The plant, due to begin delivery in 2026, will ramp up to 60 gigawatt hours of capacity -- enough to supply around 1 million electric vehicles with battery cells every year -- more than each of VW's planned plants in Germany and Spain but below CATL's mega-investment in Hungary of a 100 gigawatt-hour plant. Northvolt's investment will create 3,000 direct jobs in Heide and thousands more in the surrounding industry and service sector. Local councils this week approved the draft development plan for the plant, clearing a major administrative hurdle. Northvolt and the state of Schleswig-Holstein signed a memorandum of understanding in March 2022 to develop a battery plant in the region but the company later said it may prioritize expansion in the U.S. ahead of Europe in light of more favorable subsidies and lower energy costs. A second plant could also be constructed in parallel elsewhere, a spokesperson said, indicating the decision to build in Germany did not exclude the possibility of a further plant in North America. While Europe has been able to attract big investments for the chip industry from the likes of Intel with lure of subsidies, the U.S. has offered major tax subsidies to cut carbon emissions and boost domestic manufacturing. (Reuters) PARIS -- France beat out competition from Germany and the Netherlands for ProLogium's first overseas car battery plant with lobbying from President Emmanuel Macron, deal sweeteners and competitive power prices, executives from the Taiwanese company said. After narrowing a list of countries down from 13 to three, ProLogium said it settled this week on the northern French port city of Dunkirk for its second gigafactory and first outside Taiwan. With production slated to begin 2026, the supplier's factory will be the fourth battery plant in a northern France, adding to an emerging specialized cluster central to Europe's electric car industry. Europe currently largely depends on batteries made in Asia for electric cars, and national leaders are offering various incentives to kick start the industry. That has become more urgent since the United States last year passed its $430 billion Inflation Reduction Act, which includes major tax subsidies to cut carbon emissions while boosting domestic production and manufacturing. Macron, who personally met with ProLogium CEO Vincent Yang at the start of the vetting process, was due on Friday to officially announce in Dunkirk the 5.2-billion-euro ($5.7 billion) investment. Gilles Normand, ProLogium executive vice-president, said that after Macron, a former investment banker, pitched Yang more than a year ago Finance Minister Bruno Le Maire followed up and helped make the company's case with the European Commission for EU financial incentives. "There was then the realization that there might be some interesting possibilities, which was maybe a little bit different from the clichés about France," Normand told a small group of journalists. The timing of the investment is fortuitous for Macron, who is trying to turn the page on months of strikes and protests over his plans to raise the retirement age two years to 64 and show skeptical voters his pro-business push is bearing fruit. ProLogium expects the project to create 3,000 jobs directly and four times as much indirectly, a boon in a region where both the far right and far left score high after years of industrial decline. The emergence of an industrial cluster around the three battery plants already in the works was in itself an attraction, offering a critical mass of material suppliers and skilled workers, Normand said. Also playing in France's favor was also its competitively priced zero-carbon electricity, produced by one of the biggest fleets of nuclear plants in the world but also increasingly by offshore wind farms and solar. Normand added that the government sweetened the deal with an incentives package but could not give details while further subsidies were under review at the European Commission. Macron's government is eager to use the recent relaxation of EU state aid rules to offer new tax breaks and other subsidies to encourage investment in green technologies. He announced on Thursday that the government would offer a new tax credit worth up to 40 percent of a company's capital investment in wind, solar, heat-pump and battery projects. Meanwhile, the government also hopes to boost consumer demand for European-made electric cars by conditioning a 5,000-euro cash incentive to vehicles meeting demanding low-carbon standards in their production, effectively shutting out non-European cars. (Reuters)

- 4962 risposte

-

- transizione ecologica

- bev

-

(e 2 altri in più)

Taggato come:

-

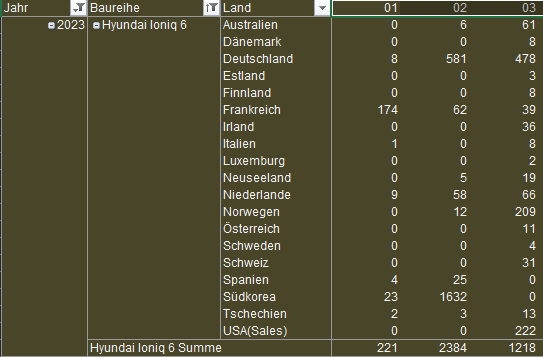

Si, naturalmente hai ragione, con la "6" ho scambiato..🙄 Io6 al momento e in vendtita solo in pochi mercati

- 73 risposte

-

- 1

-

-

- hyundai ioniq

- hyundai

-

(e 2 altri in più)

Taggato come:

-

- 13 risposte

-

- nio et5 shooting brake

- nio

-

(e 3 altri in più)

Taggato come:

-

Non uso mai un treno…gia per principio 😜

- 266 risposte

-

- 2

-

-

- alfa romeo bev

- new stelvio

- (e 8 altri in più)

-

Boh…figurati…non potrebbe e non deve essere per una Alfa. Oggi pomeriggio/sera ho fatto 850km autostrada da Baviera verso Nord Germania, ho incrociato tante volte Tesla che sono anche marciata con 180-190-200km/h. Se una nuova Giulia bev non sara in grado di camminare simile, poi sarebbe gia indietro di una Tesla anni di luce.

- 266 risposte

-

- 1

-

-

- alfa romeo bev

- new stelvio

- (e 8 altri in più)

-

The Wuling Xingyun will be manufactured by SAIC-GM-Wuling (SGWM), a joint venture between SAIC Motor, General Motors, and Liuzhou Wuling Motors. The joint venture was established in 2002 and started the business by selling minivans and minibusses under the Wuling brand. The size of the car is 4610/1810/1670mm, with a 2700mm wheelbase. The car will run on 17-inch pedal-shaped wheels. From the side, the roof is equipped with silver decorations. The A, B, and C pillars are all blackened. Power will come from a hybrid system consisting of a 2.0L engine (model is LJM20A) and an electric motor. The maximum power of the engine will be 100 kW. The top speed will be 135 km/h.

-

- 73 risposte

-

- hyundai ioniq

- hyundai

-

(e 2 altri in più)

Taggato come:

-

- 4962 risposte

-

- transizione ecologica

- bev

-

(e 2 altri in più)

Taggato come:

-

Il mercato globale totale pre-covid ha avuto un volume di ca. 80Mio, 2022 eravamo a ca. 70Mio. Cina + Europa stanno per quasi 50% delle vendite globale (48-49%). Nord america per altri 28-29%.

- 4962 risposte

-

- 1

-

-

- transizione ecologica

- bev

-

(e 2 altri in più)

Taggato come:

-

COPENHAGEN -- Volvo has delayed the production start of its new EX90 all-electric flagship for more software development and testing. The company now expects to start production of the SUV in the first half of next year, Volvo said in a statement on Thursday. Volvo unveiled the model late last year, expecting it to hit showrooms in early 2024. Demand for the car remains high, Volvo said. Doing further work on the vehicle’s software will help ensure a quality experience for all customers, the company said. Production was previously planned to begin at the end of 2023, a Volvo spokesperson said. He declined to say when the company now expects the model to reach showrooms. The biggest all-new product debut for Volvo Cars in half a decade will have standard safety equipment that goes "beyond that of any Volvo before it," the automaker's CEO, Jim Rowan, has said. The EX90 full-electric premium large SUV will replace the XC90 as Volvo's flagship. It will have an "invisible shield of safety" that can help reduce accidents that cause serious injuries or death by up to one-fifth, Roawan said. Polestar delay In a separate statement, Volvo sister brand Polestar said its Polestar 3 will also be delayed because it shares new all-electric vehicle underpinnings with the EX90. Production should begin during the first quarter of next year, Polestar said. Polestar also reduced its forecast for this year to between 60,000 to 70,000 vehicles because of the delay as well as a slowing economic environment. It had previously aimed to make about 80,000 cars in 2023. Polestar 4 is going ahead as planned with a launch in China in the fourth quarter and other markets in early 2024. Automakers have started to run into trouble on aligning complex development and production schedules for future vehicles decked out with sophisticated digital offerings. Volkswagen Group has delayed key models including the Porsche electric Macan for at least two years because it couldn’t get the software ready on time, and EV startup Fisker cut its output forecast after struggling with software integration problems. (Bloomberg/Reuters)

- 62 risposte

-

- bev

- volvo ufficiale

-

(e 4 altri in più)

Taggato come:

-

LONDON -- Volkswagen Group's Cariad plans to bring its delayed 2.0 software platform to market in 2027 or 2028 after the launches of key new electric models from Porsche and Audi. The original launch date for the sophisticated software platform, which will allow Level 4 autonomous driving, was 2025 but its development has been hit by delays and overspending at Cariad since the software unit was set up by former VW Group CEO Herbert Diess. VW Group will first concentrate on its Software 1.2 platform, which will be rolled out starting next year in premium all-electric models including the Porsche e-Macan and Audi Q6 e-tron, Chief Financial Officer Arno Antlitz said. "There will be great cars on that platform... that gives us a little flexibility to postpone 2.0 to 2027, 2028," Antlitz said at the Financial Times Future of the Car conference on Thursday. Intel unit Mobileye will supply its SuperVision "eyes on, hands off" semi-autonomous driving package to Porsche models using the Software 1.2 platform, Mobileye CEO Anmon Shashua told Automotive News Europe. The electric Macan and Q6 e-tron have been delayed because the 2.0 software they were originally supposed to use is not ready. Both models are crucial to position VW's premium brands at the forefront of EV technology. The problems have also pushed back VW brand's Trinity flagship EV toward the end of the decade. VW Group CEO Oliver Blume is shaking up Cariad. He has appointed Bentley production chief Peter Bosch to lead the software unit from June 1, replacing Dirk Hilgenberg, who will be given other tasks within VW Group. Two software experts will join Cariad's management board alongside Bosch. "This will be a very strong team that focuses on the turnaround of Cariad," Antlitz said. The aim was to rely more on outside partners and do less in-house to reduce cash burn as the carmaker attempts to build up its software expertise, he said. VW Group's ultimate goal is a unified software and electronics architecture for all group vehicles. It will rely on Qualcomm "system on a chip" semiconductors in Europe and North America, and in China will use super-chips developed with Chinese partner Horizon Robotics. (Reuters)

- 1442 risposte

-

- 2

-

-

- italdesign

- jetta

-

(e 15 altri in più)

Taggato come:

-

Ferrari overtakes Stellantis as value climbs past $50B Ferrari stock has gained 34 percent this year, giving it a market value of $53.9 billion, overtaking Stellantis's $51.48 billion. Ferrari’s market value has surpassed that of Stellantis, the auto group that contains Fiat, which was once the parent of the iconic Italian luxury sports-car maker. Ferrari has gained 34 percent this year, making it the best-performing stock among European auto manufacturers. That has sent the market value soaring to 49.2 billion euros ($53.9 billion), overtaking Stellantis’s 47.1 billion euros ($51.48) and making it one of the three biggest companies on the Milan stock exchange. Demand for luxury sports cars has held up well among Ferrari’s wealthy customers even as it increased prices, a stark contrast to mass automakers losing pricing power as the economy heads for a slowdown. The stock in many ways is comparable to that of big luxury goods firms in Europe, producing total returns in excess of 500 percent since its spinoff in 2015. During the same period, returns for auto stocks in Europe were about 50 percent, including dividends. For a growing crowd of investors, the luxury sector is to the European stock market what Big Tech has been to the U.S.: Dominant businesses whose growth holds up even as the economy waxes and wanes. LVMH Moet Hennessy Louis Vuitton, Europe’s largest company by market value, making it into the top 10 in the world is a testimony to the trend. Exor, the Agnelli family holding company, is still the largest investor in both Stellantis and Ferrari, which was separated out from Fiat Chrysler in 2015. Ferrari had a market value of about $10 billion when it was listed in New York in October 2015. “Ferrari has always been synonymous with luxury, and its multiples also confirm this,” said Vincenzo Longo, a market strategist at IG. “The stock has been outperforming year-to-date and the trend is about comparable to the big luxury names such as LVMH.” While Ferrari is benefiting from a surge in demand for its luxury cars, Stellantis shares have been under pressure after the company posted disappointing first-quarter sales in Europe on May 3, reflecting a looming downturn in the region driven by inflation and higher interest rates. Stellantis’s 14 car brands include Fiat, Alfa Romeo, Citroen, Opel and Chrysler, and its total consolidated shipments last year fell to about 5.78 million vehicles. The high-premium brand Ferrari sold 13,221 units. Ferrari's share price may already reflect some market expectations, however. Ferrari is trading at about 41 times 12-month forward earnings, by far the most expensive car stock in Europe and almost in line with Tesla in the U.S. “We thought we were covered for a while by setting estimates straight above guidance at the start of the year, but the earnings power of Ferrari keeps accelerating,” Jefferies analysts including Philippe Houchois wrote in a note on Monday, raising their estimates and price target on the stock to 250 euros. (ANE)

-

- 18 risposte

-

- 1

-

-

- ineos grenadier

- grenadier

- (e 5 altri in più)

-

MINI All Electric JCW 2025 - Prj. J01 BEV (Leak)

4200blu ha risposto a sonicwp7 in Scoops and Rumors

...vedo molto simile, si.- 388 risposte

-

XM e una nicchia, ma la richiesta e sopra la capacita produtiva, hanno gia aumentato il volume come possibile, ma ci sono due limiti, la prima la capacita totale di Spartanburg dove XM sta in concorrenza con X3/4/5/6/7 (e dove si raggiunge quest'anno anche un all-time-high dei auto prodotti in questa fabbrica, nonostante l'assemblaggio in parallelo della X5 in Cina) e la seconda, la capacitaproduttiva limitata del V8-Phev.

- 265 risposte

-

- 4

-

-

-

..benissimo...molto probabile (se non c'e altra guerra, epidemia, collasso bancario ecc) diventera un anno record per la 7er.

- 265 risposte

-

- 2

-

-

...loro (BYD) sono difficili da battere sul prezzo, perche tutta la catena della produzione (miniera di litio - cellule - battery pack - auto) e in loro mano stesso, tutti gli altri, anche Tesla devono comprare il litio gia lavorato oppure ancora un step in piu, le cellule completo, quindi per una batteria non hanno mai i stessi prezzi rispetto BYD.

-

MINI All Electric JCW 2025 - Prj. J01 BEV (Leak)

4200blu ha risposto a sonicwp7 in Scoops and Rumors

...sopratutto sono materiali sostenibili e reciclabili...uno dei nuovi mantra.- 388 risposte

-

...si, ma sopratutto in Cina...se la 5er non funzionera in Cina poi BMW avra un problema serio, e una delle cash cows in assoluto.

- 265 risposte

-

..esattamente questo e il punto...solo 7%...mancano coorte di software engineers, medici, artigiani di tutti i settori, sopratutto quelli che sono in grado di montare, installare tutti questi neccessita del ecosostenibilita, personale in diversi settori di prestazione di servizio, mancano gente che fanno ricerce e sviluppi nella biotecnologia, informatica, farmacia, nuovi prodotti alimentari, ma anche camionisti, personale nelle ospedale, ai aeroporti, alla polizia ecc ecc. Vanno in pensionie millioni di boomer nelle prossimi anni, quindi la mancanza della forza di lavoro diventera molto piu grave nei prossimi anni - in futuro non abbiamo bisogno di una grande industria automotive, si puo fare forse i settori di alta gamma, lusso in Europa, ma tutto il resto si puo fare anche in Cina, Vietnam, India e una volta Africa. ...oppure la filosofia iphone, due modelli, due grandezze dello schermo, 4 colori, 4 capacita della memoria...basta. E qui funziona molto bene.

-

Domanda forse un po' provocativo: Perche e cosi problematico quando l'automobile con il giro verso le bev diventera un prodotto come molti altri, che non vale la pena una produzione costosa in Europa, sara un prodotto abbastanza semplice (il auto, non tutti i componenti che si compra come OEM come le cellule delle pack e la software) che si puo produrre tranquillamente anche in paesi altri. Europa deve concentrarsi su prodotti e technologie dove conta la formazione della gente e dove non conta un ambiente caro per produrrla. Con la sua popolazione a contrarsi questa neanche dovrebbe un problema, gia oggi manca la forza di lavoro in molti settori.

-

...con i cerchioni a 23" si potrebbe lasciare subito fuori i pneumatici......

- 5216 risposte

-

- 3

-

-

- 1.5 mhev

- alfa romeo ufficiale

-

(e 4 altri in più)

Taggato come: