-

Numero contenuti pubblicati

14093 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

65

Tipo di contenuto

Forum

Galleria

Calendario

Download

Articoli del sito

Store

Blog

Tutti i contenuti di 4200blu

-

Gia nella prima riga del capoverso per la nuova architettura e il primo errore...se avete acoltato Zipse alla CES con attenzione, poi sapete che la data della partenza sara 2025, non 2027....oltre questo nel articolo sono altri malintesi

- 265 risposte

-

Non Ti posso dire sicuro, ma vedendo lo sviluppo del volume delle bev, 2021 ca. 100.000 al anno, 2022 piu di 200.000, quest'anno ancora molto di piu come 2022 e per 2024 ulteriore aumento, con al momento tre fornitore (CATL, Samsung e EVE) piu Northvolt a fine d'anno, e una produzione propria delle battery packs a baviera di basso, da dove si riforniscono al momento Dingolfing, Monaco e Ratisbona, non credo, che le cellule delle packs per un modello specifico hanno sempre la stessa origine.

- 149 risposte

-

- 1

-

-

- bmw ev

- elettrico bmw

-

(e 10 altri in più)

Taggato come:

-

Non devi credere tutto cosa 4R scrive.

- 265 risposte

-

- 1

-

-

..al momento e solo una soluzione provvisoria...la soluzione finale fra pocchi anni sara quella....😝

- 92 risposte

-

- 1

-

-

- bmw serie 3 2022

- bmw ufficiale

- (e 6 altri in più)

-

Renault picks managers to prepare EV business for IPO CEO Luca De Meo has selected around 15 in-house managers for the Ampere project including a former Apple executive. Science chief Luc Julia, who co-developed Apple's Siri voice-recognition service, will focus on artificial intelligence technology, while manufacturing executive Luciano Biondo will be in charge of operations including purchasing and quality control, the people said. The managers are still busy with the entity's carve out and will also continue in their day-to-day jobs, they said. A spokesman for the company declined to comment. Renault is in the middle of a sweeping overhaul to raise funds for EV development and narrow the gap with bigger rival Stellantis. Japanese partner Nissan has pledged to buy as much as 15 percent of Ampere and Mitsubishi Motors is considering an investment. Qualcomm, the largest maker of smartphone processors, will also back the business. "The car must now go beyond the physical object," de Meo wrote in a LinkedIn post on Thursday. "Today, it's all about connecting it to the cloud, to the digital ecosystem, and turning it into an extension of our digital spaces." The CEO has said listing Ampere toward the end of this year would be ideal. Renault is aiming for a roughly 10 billion euros ($10.6 billion) valuation, Bloomberg reported in November. (ANE)

-

Ford is slashing its workforce in Spain where the automaker is winding down production of once-popular models. The company plans to cut 1,100 jobs at its plant in Valencia in eastern Spain, a Ford spokesperson said on Friday. The layoffs are part of the company's changes to its car production lineup in Europe, the spokesperson said. "Ford will work constructively with its union partners to reduce the impact of the separations on employees, their families, and the local community," the spokesperson said. Ford is ending production of the S-Max and Galaxy minivans built in Valencia in April as it shifts its passenger car lineup to SUVs and electric cars. Ford also builds the Transit Connect compact van and the Kuga compact SUV in Valencia. The Mondeo midsize car went out of production at Valencia last year. In February Ford said it will cut 3,800 product development and administration jobs in Europe, mostly in Germany and the UK. It cited rising costs and the need for fewer workers to build EVs as the reason for the jobs cull. Ford will unveil a new full-electric vehicle for Europe on March 21. It will be built at the automaker's factory in Cologne, Germany, on Volkswagen Group's MEB platform. The EV will replace production of the Fiesta small car in Cologne. Ford will end production of the Focus compact car in Saarlouis, Germany in 2025. The company is looking for a buyer for the factory. Last year, Ford said it will build its next-generation electric vehicles in Valencia on a new U.S.-developed platform. It delayed a final decision but said it would stick with a plan to start producing electric vehicles later this decade at the factory. (Reuters)

- 320 risposte

-

SOP fra qualche mesi.

- 265 risposte

-

- 1

-

-

- 265 risposte

-

- 1

-

-

Piu importante come la otticca sara la funziona. Spero per loro che i problemi con le sensori lidar/radar vengano risolti rapidamente, perche la ET7, in una prova di AutoMotor&Sport, per il funzionamento dei assistenti autonomi non ha fatto un bella figura.

-

Purtroppo no, stranamente per USA non hanno fatto questa paragone.

- 333 risposte

-

- stelvio 2023

- alfa romeo

- (e 5 altri in più)

-

...forse dipende semplicimente dalle tempistiche per altri berline E del gruppo, DS, Opel, Chrysler...perche sicuramente non faranno una berlina E solo sotto la sigla Alfa. Huettl, il CEO della Opel poche settimane fa in un intervista con AM&S ha parlato di un grande Opel, che non sara la Monza...forse un altro clone di questa berlina E oppure altra possibilita, erede per la 300C.... Secondo me si potrebbe solo valutare, quando si conosce tutto la gamma pianificato del gruppo. Alfa e solo un piccolo elemento del complesso.

- 3039 risposte

-

- 1

-

-

- alfa romeo spy

- stellantis

-

(e 2 altri in più)

Taggato come:

-

Colonia.

-

..credo che un giornalista (forse gia uno della Handelsblatt o forse anche uno della 4R ha qualcosa malintepretato o forse e basata su vecchie commentari), lo stato attuale per la Ncar almeno e bev/fcell, non ice/hev. Oppure hanno combinato sbagliato, perche la affermazione che BMW produce per qualche anni bev su NK e auto ice/hev in parallelo per se non sara falso, solo non su base della stessa piattaforma.

- 344 risposte

-

- 1

-

-

...boh...Imparato parla molto...ma fino adesso non ha fatto altro che parlare.....

- 3039 risposte

-

- 12

-

-

-

-

- alfa romeo spy

- stellantis

-

(e 2 altri in più)

Taggato come:

-

...solo che queste cifre non comprendono gli usa, sono solo i mercati big5 europei.

- 333 risposte

-

- stelvio 2023

- alfa romeo

- (e 5 altri in più)

-

XPeng G6 electric fastback SUV unveiled in China with 487 hp Previously, the XPeng G6 was known by its code name, F30. It will soon become the fifth EV in the brand’s model line. As for the dimensions of the G6, they are 4753/1920/1650 mm with a wheelbase of 2890 mm. For an example, it is 97 mm shorter, 45 mm narrower and 64 mm lower than the current generation of the Nio EC6. The G6’s curb weight differs from 1995 kg to 2100 kg, depending on the powertrain. It also has 235/60 R18, or 255/45 R20 wheels. As for the departure angles, they are 16 and 20 degrees, respectively. The XPeng G6 will be available with rear-wheel drive or four-wheel drive. Its base version goes standard with a single electric motor for 218 kW (296 hp). As for the four-wheel-drive version, it is called ‘Performance’ and is equipped with two electric motors with a combined power of 358 kW (487 hp). Regardless of the powertrain, the G6’s top speed reaches 202 km/h. Worth mentioning that all the electric motors are manufactured by Wuhan XPeng Intelligent Manufacturing. Speaking about the batteries, their capacity is yet to be revealed. But we do know that they are ternary (NMC) or LFP made by CALB Group. The XPeng G9 uses the batteries from the same supplier. Their capacity is 78.2-98 kWh. The XPeng G6 is ready for the mass production if China. It seems that it will hit the market soon this year.

-

...questo non credo personalmente, solo che questi stati hanno molto piu soldi, molto piu potere e in caso di Cina molto piu direttiva e influsso dallo stato per formare i catene della fornitura in loro gusto. Un europa povera e finanziariamente debole, inoltre spesso essendo in rotta, e sempre in svantaggio in cose strategiche globale e geopolitiche.

-

molto Porsche dietro...

- 3 risposte

-

- 1

-

-

...la tua impressione sta bene insieme con queste date di una studia clienti di una Suv-D nelle stati EU big-5, purtroppo Stelvio no fa parte della studia, ma non credo che sarebbe molto diverso il risultato

- 333 risposte

-

- 1

-

-

- stelvio 2023

- alfa romeo

- (e 5 altri in più)

-

In un intervista tra Klaus Zellmer, CEO SKoda, e AutoMotor&Sport pubblicato oggi nella nuova rivista, Zellmer conferma, quando sara approvato la Euro/ come proposta al momento del governo europeo, significa lo stop della produzione di Fabia e Polo. Anche il resto della gamma Skoda/Vw con un Eu7 come pianificato sara ridotta considerevole, perche altrimenti i costi per la Eu7 non saranno gestibile.

-

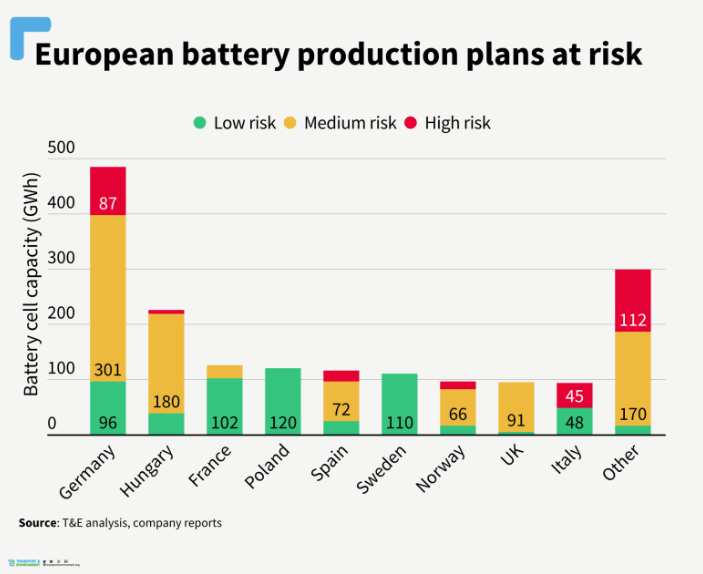

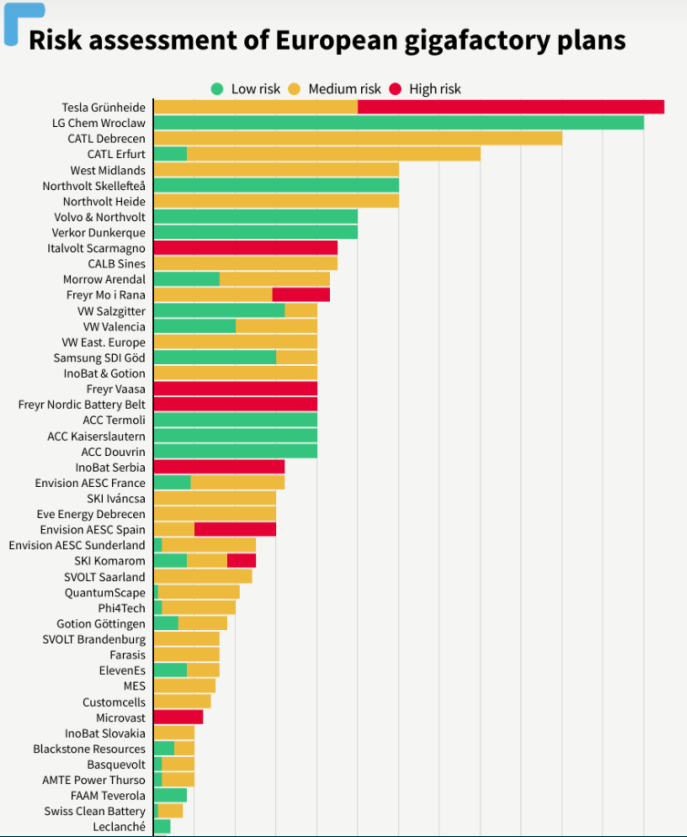

....di quale molte sono a rischio grazie la IRA dei Usa: Two-thirds of European battery production at risk – analysis IRA subsidies are chief threat to gigafactory plans unless Europe offers accessible incentives and streamlined permitting. More than two-thirds (68%) of lithium-ion battery production planned for Europe is at risk of being delayed, scaled down or cancelled, new analysis shows. Tesla in Berlin, Northvolt in northern Germany and Italvolt near Turin are among the projects that stand to lose the greatest volumes of their slated capacity as the companies weigh up investing in the US instead. Transport & Environment (T&E), which conducted the research, called for both EU-wide financial support to scale up battery production and faster approvals processes to capture projects at risk from American subsidies. Battery production capacity equivalent to 18 million electric cars – 1.2 TWh – is at a high or medium risk of being disrupted or lost. Without this expansion, Europe will not be able to satisfy its battery demand in 2030 and will need to import from foreign rivals. T&E used publicly available information to assess the 50 gigafactories announced in Europe based on their finance and permits, whether they had secured a location, and the companies’ links to the US. Julia Poliscanova, senior director for vehicles and emobility at T&E, said: “EU battery manufacturing is caught in the crossfire between America and China. Europe must act or risk losing it all. A green industrial policy focused on batteries with EU-wide support for scaling up production is urgently needed to react to US subsidies and China’s years of dominance.” Germany, Hungary, Spain, Italy and the UK stand to lose the most if battery-makers change their plans. Tesla’s Giga Berlin plant has the largest volumes at risk of being delayed in Europe after the company said it will focus cell manufacturing in the US to take advantage of incentives under the Inflation Reduction Act. There is a medium risk to Northvolt’s planned gigafactory in Heide, Germany, as the company has only secured part of the funding and has not started construction. Also, Northvolt’s CEO said last October that it might delay the plant and prioritise expansion in the US. Italvolt, whose CEO also founded the failed Britishvolt, is at risk of being deprioritised in favour of its sister project, Statevolt, in California. To avoid the fate of Britishvolt, the planned West Midlands gigafactory in the UK still needs to find an investor. The report also places question marks over projects in Serbia and Spain by InoBat, which recently secured incentives for a joint venture with an American company in Indiana. Europe’s global share of new investment in Li-ion battery production dropped from 41% in 2021 to a meagre 2% in 2022, according to BloombergNEF. Battery investment in the US and China continued to grow, and European companies have already signalled expansion in America. T&E said that companies’ limited resources to scale up production, as well as the tight supply of raw materials, are making the US-Europe battery race a zero-sum game. Julia Poliscanova said: “Europe’s response should mirror the US Inflation Reduction Act in focus, simplicity and visibility. A central fund accessible to all member states should prioritise battery value chains, renewables and smart grids. The EU can’t compete unless it has a robust industrial policy which is focused on scaling up production and rewards environmentally sustainable projects.” On 14 March, the EU Commission will publish a Net Zero Industrial Act, part of its response to the tax benefits and subsidies provided by the IRA for localising battery supply chains in America. T&E called for production targets, tax breaks and grants to scale up battery manufacturing while fully upholding Europe’s environmental standards. It also said a green simplification agenda was needed to streamline permitting and approval processes for projects. (© 2023 European Federation for Transport and Environment)

-

….entro la fine dell'anno la legge sarà già stata approvata da tempo.

- 4962 risposte

-

- 1

-

-

- transizione ecologica

- bev

-

(e 2 altri in più)

Taggato come:

-

...non sembra che Spagna ha voglia di cambiare opinione..... Germany may set a dangerous precedent by challenging a European Union agreement to phase out new combustion-engine cars starting in 2035, Spain's deputy prime minister said. Modifying the proposal so late in the debate could disrupt the way the bloc crafts key policies in the future and send confusing signals to investors and industries planning for the shift to clean energy, Teresa Ribera said in an interview. Germany, where auto manufacturing is the cornerstone of the economy, asked the EU’s executive arm to exempt cars powered by synthetic fuels, throwing a wrench into an already agreed-upon plan to reduce carbon emissions. Italy subsequently joined Berlin in threatening to derail the ban, with the government of Prime Minister Giorgia Meloni arguing it makes little sense and puts thousands of jobs at risk. “It’s disappointing,” said Ribera, who’s also Spain’s environmental transition minister and is pushing for quicker cuts to emissions. “What if other governments decide to do something similar on whatever issue? The procedural rules are for everybody.” Germany’s auto industry employs about 800,000 people and has revenue of about 411 billion euros ($435 billion). Spain is the continent’s No. 2 car producer, with the industry responsible for about 11 percent of its annual economic output. Prime Minister Pedro Sanchez is pledging more than 4 billion euros to transform the industry and make the nation a hub for electric vehicles. The European Commission should not delay its final decision on the proposed 2035 ban, Ribera said. The dispute could be resolved in another venue, such as negotiations on Euro-7 emission rules, to prevent ripping up the current proposal and starting discussions from scratch, she said. Ribera attributed Germany’s objections to strife within Chancellor Olaf Scholz’s ruling coalition. “They may have a domestic political difficulty, but now they have exported their domestic political difficulty to the whole European Union,” Ribera said, adding that the bloc still needs to assess the impact of synthetic fuels on carbon-reduction goals. A final EU vote on the ban agreed upon last year was scheduled for March 7 but then delayed amid fears Germany may abstain. EU and German officials are in talks to find a compromise. (Bloomberg)

- 4962 risposte

-

- 2

-

-

-

- transizione ecologica

- bev

-

(e 2 altri in più)

Taggato come: