-

Numero contenuti pubblicati

14759 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

71

Tipo di contenuto

Forum

Galleria

Calendario

Download

Articoli del sito

Store

Blog

Tutti i contenuti di 4200blu

-

...forse per avere un prodotto con qualita piu alta, per non avere un ammasso di ruggine dopo qualche anni, per avere un servizio cliente con officina vicina, per avere un macchina NON tutto touch, per avere ricambi disponibile ecc. ecc.

- 727 risposte

-

- tesla

- scelte strategiche tesla

-

(e 1 altro in più)

Taggato come:

-

...boh - troverete logico questo modo di procedere? Posso capire che una abassa i prezzi fino ad un punto dove riempe la capacita produttiva a 100%, potrebbe essere meglio come lasciare vuoto qualche capacita. Ma se hai la domanda doppia rispetto la capacita, poi abassare i prezzi a me non sembra molto logico perche poi e solo creare backlog. Ma vededendo i tempi di consegna per le diverse Tesla, quasi tutti tra 1 e 2 mesi, non c'e molto backlog. Quindi questa storia con la doppia richiesta per me e almeno dubbioso.

- 727 risposte

-

- 2

-

-

- tesla

- scelte strategiche tesla

-

(e 1 altro in più)

Taggato come:

-

...sicuro?? C'e anche Bühler (Svizzera) e Ube (Giappone) con la stessa tecnologia e non tutti i OEM vogliono condividere i loro costruzioni con i Cinesi (casa madre di Idra)...😜

- 11932 risposte

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

...nonostante il prezzo basso della 3 in tutta l'Europa (e anche in Italia) la piu cara Y vende molto di piu....😉

- 727 risposte

-

- tesla

- scelte strategiche tesla

-

(e 1 altro in più)

Taggato come:

-

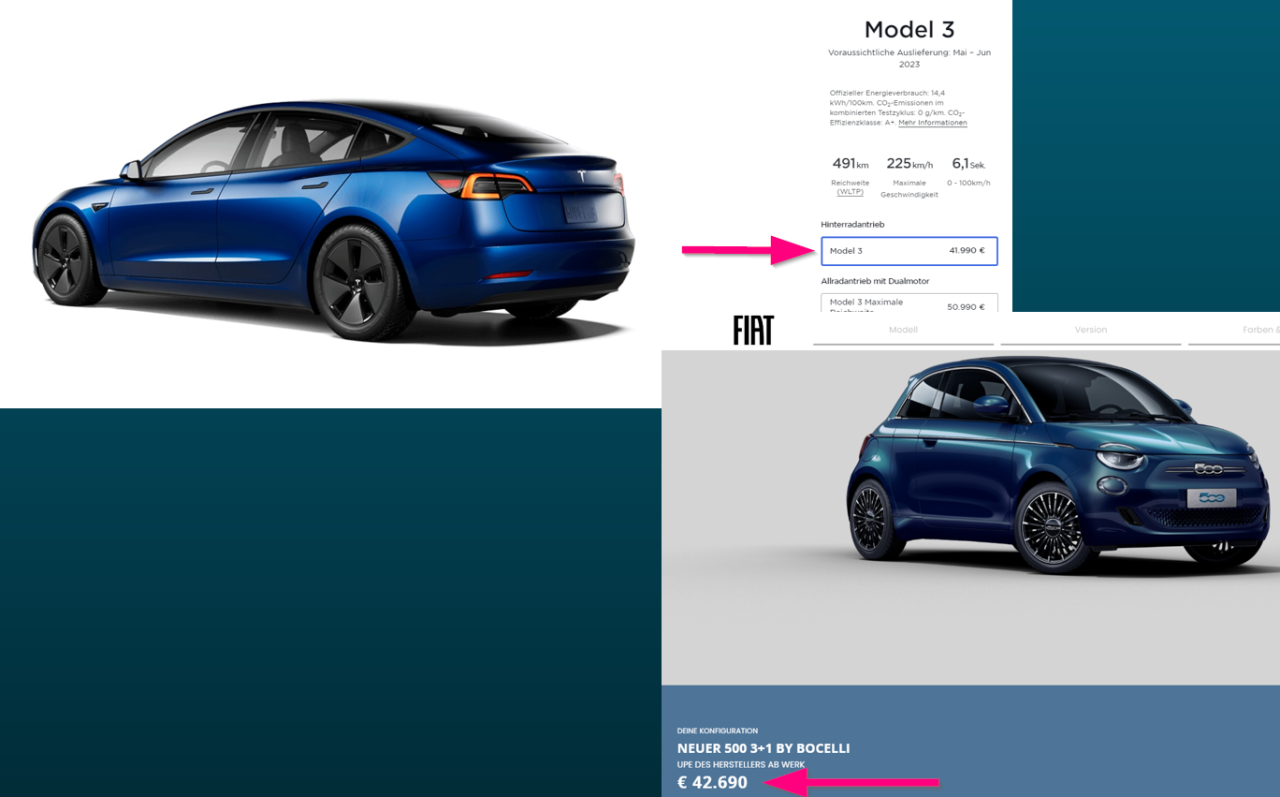

Si e no...dipende delle coste interne, ma sicuramente la motivazione principale per il lamento di Tavares. Se i suoi costi per macchine cosi sono davvero cosi alto che bisogna chiedere prezzi cosi, poi una Stellantis e anni di luci lontano dalla efficienza di Tesla, che vende praticamente vende la 3 base (in Germania 41.900.-) allo stesso prezzo di una e-2008 (pre-facelift, in Germania 41.000.-) a fa una reddita piu alta. Se i prezzi di Stellantis sono solo cosi alti er fare margine grossa, poi ci sara anche una problema per Tavares, perche a questi prezzi quasi nessuno comprera una B-Suv di Stellantis ma tutti con i stessi soldi una Tesla, cosi i margini grossi non esistono piu perche mancerano le vendite.

- 11932 risposte

-

- 1

-

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

...Boh...Mokka-e parte (almeno in Germania) da 40.600.-, non credo che una 600 (essendo quasi la stessa macchina) sara molto di sotto, forse 39.500 oppure 38.900.-

-

Recently, Great Wall Motors (GWM) signed a memorandum with the São Paulo state government in Brazil to upgrade the Iracemápolis plant. The plant will become Brazil’s first new energy vehicle factory specializing in the production of hybrid, hydrogen, and electric vehicles. The upgrade will commence in the first half of this year to increase the production capacity to 100,000 vehicles per year. The new plant is expected to officially start operations on May 1, 2024. 2,000 new jobs will also be created locally, according to GWM. GWM purchased the Iracemápolis plant from the Daimler Group on August 18, 2021. Furthermore, GWM plans to invest more than 10 billion Brazilian Reals for its operations in Brazil in the next 10 years. The Iracemápolis plant will also serve as GWM’s fourth largest production base in the world, covering both the Brazilian domestic market and the rest of the Latin American new energy vehicle market. A hybrid flex-fuel pickup truck will be the first vehicle that will be manufactured at the factory for the Brazilian market. GWM indicated that it is currently developing and testing the hybrid flex-fuel truck. According to the carmaker, plug-in hybrid vehicles powered by ethanol are one of the best technical solutions to meet the needs of the Brazilian market due to Brazil’s geographical environment with complex road conditions and energy infrastructure. Currently, 80% of Brazil’s electricity comes from renewable energy, which is much higher than the global average of 30%. According to Tarcísio de Freitas, Governor of Sao Paulo, ethanol will be the bridge to achieve hydrogen vehicle commercialization and the technology to convert ethanol to hydrogen is already in place; with just some incentives, ethanol plants producing hydrogen will be possible. Brazil also shared that it is willing to provide support for new energy technology projects between Brazil and China in the realms of clean energy and hydrogen technology to solve global issues such as climate change. (CNC)

-

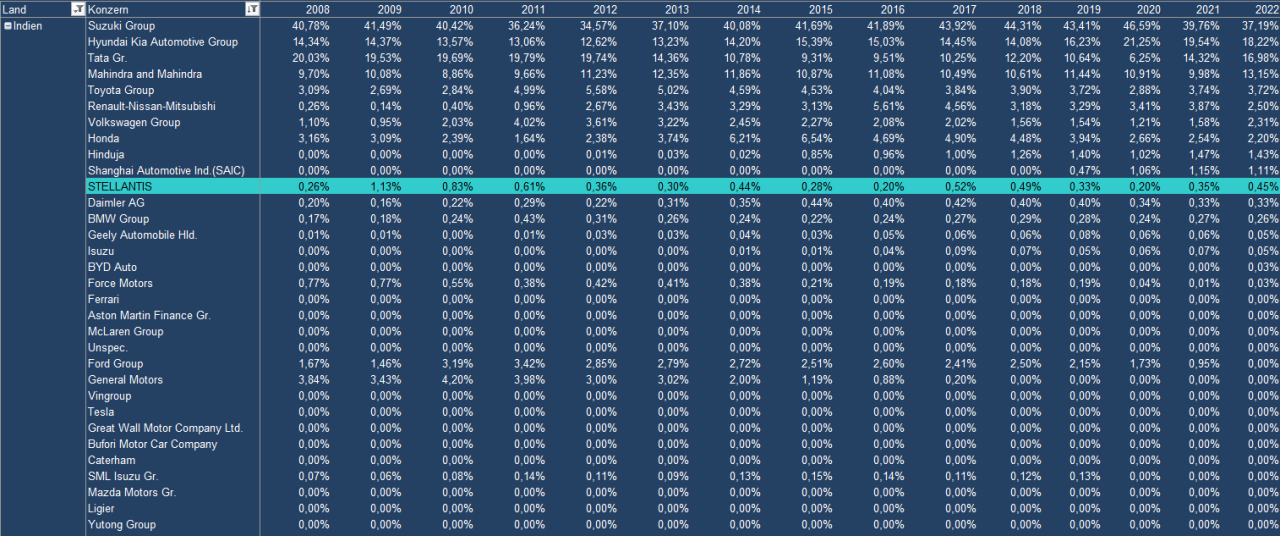

Boh...la crescita enorme del mercato Brasile non vedo direttamente e India ha una certo crescita del mercato totale ma non per la quota mercato di Stellantis

- 11932 risposte

-

- 1

-

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

si si...solo che Brasile ha un volume simile UK e Argentina simile Belgio, in vista globale naturalmente importantissimo di essere prima in questa regione...

- 11932 risposte

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

- 98 risposte

-

- 1

-

-

Si hai ragione con queste zono che saranno sicuramente per lungo termine non elettrificbile. Ma devi d'altra parte prendere in considerazione, che volume rappresentano queste zone per il mercato globale. Europa, America nord, Cina, Giappone e Corea sud stanno insieme per ca. 80% delle vendite globale. E questi sono tutti zone elettrificabile. Il resto del mondo (con aree di grande potenziale per crescere a lungo termina come India, Asia est e Africa) gia oggi non e terreno per produttori europei, cosi per loro in queste zone e poco da perdere. Se fai un giro a Mombassa o Nairobi cosa vedi? Sopratutto (direi 70% al occhio) vecchie Toyota, poi altri giapponesi e al massimo qualche vecchie Mercedes. Quindi la lotta per i mercati futuri ice sara tra Toyota e i Cinesi e forse Indiani (in futuro), ma gli europei non hanno carte in gioco in questo caso e Stellantis (senza ramo ex-Chrysler) comunque gioca solo in Europa gia adesso.

- 11932 risposte

-

- 2

-

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

Vedremmo...al momento secondo me hann al massimo una richiesta piu o meno equivalente alla capacita produttiva oppure anche meno. Almeno in Germania lo stock di pronto consegna sembra abbastanza grande. Se prendi una Y non configurata ma "subito pronto" ci sono consegne intorno 3-5 giorni almeno per certe versione (Performance per esempio).

- 727 risposte

-

- tesla

- scelte strategiche tesla

-

(e 1 altro in più)

Taggato come:

-

- 11932 risposte

-

- 5

-

-

-

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

- 727 risposte

-

- tesla

- scelte strategiche tesla

-

(e 1 altro in più)

Taggato come:

-

MILAN -- Ferrari's core earnings rose 27 percent to 537 million euros ($594 million) in the first quarter on increased shipments. Results were driven by sales of the Portofino M, the 296 GTB and the 812 Competizione models, as well as pricing capacity, the company said in a statement on Thursday. CEO Benedetto Vigna said demand for Ferrari's cars stretched into 2025. Ferrari had decided to reopen orders for its new Purosangue, which had been suspended "due to an initial unprecedented demand," Vigna said. Ferrari unveiled the Purosangue in September. The high-riding, four-door car looks more like an SUV than the company’s traditional portfolio of low-slung, two-door sports cars. The move is expected to broaden Ferrari’s customer base. Deliveries of the 390,000-euro Purosangue are due to start in the current quarter. Vigna said customers now ordering the 12-cylinder Purosangue will have to wait until 2026 to receive it. "We were caught by positive surprise for these strong interest," he told analysts on an earnings call. Vigna confirmed Ferrari's pledge to keep Purosangue sales below 20 percent of total group shipments over the car's life-cycle and not to extend it, to retain a degree of exclusivity. Ferrari, which unveiled the Roma Spider in March, has promised a total of four new models this year. Ferrari's margin on adjusted EBITDA grew by 2 percentage points compared to the same quarter of last year, to 37.6 percent. Revenue was 1.43 billion euros. Ferrari has been hiking the prices of some of its models with its wealthy clientele less acutely affected by soaring inflation and rising interest rates. CFO Antonio Picca Piccon told analysts Ferrari was now applying mid-single digit price increases on selected models and markets it had announced last year. He said the company expected a strong second quarter, followed by a softer second half of the year -- the fourth quarter in particular -- in line with its planned product cadence. Car price increases will counterbalance current cost inflation, Ferrari said. EV shift The company is preparing to shift to electric vehicles and turn its historic factory in northern Italy into a hub for battery-powered cars. The first full-electric Ferrari is expected in 2025 and battery-only as well as plug-in hybrid models are slated to dominate the company’s portfolio in the second half of the decade. Hybrid cars made up 35 percent of shipments during the first quarter, the company said. "Ferrari's transition to an electrified future may increase its average transaction price and augment its mammoth 154,000-euro Ebitda per vehicle as ICE based products become specials," Bloomberg Intelligence analyst Joel Levington said last month. Bernstein analysts noted that Ferrari's "extremely strong" product mix, pricing power and lengthy order book protected the company against potential recession-driven order cancellations. Ferrari, which has promised its first fully electric model in 2025, confirmed its full-year forecasts, although the Bernstein analysts said they expected them to be raised later in the year. (Reuters/Bloomberg)

- 227 risposte

-

- ferrari

- scelte strategiche

-

(e 1 altro in più)

Taggato come:

-

La stampa tedesco della sinistra (Der Spiegel) mette in evidenza un'altra parte della intervista con Tavares: (traduzione con DeepL) Per 30 anni, la dura concorrenza internazionale ha mantenuto basso il costo della vita per gli europei, ha detto Tavares. La dolorosa conseguenza è che la produzione si è spostata sempre più in Asia. Questo scenario minaccia ora di continuare nell'industria automobilistica. L'importanza della produzione industriale per la performance economica dell'Europa rischia di ridursi ulteriormente. Al continente resterebbe invece solo il ruolo di popolare destinazione turistica: "Tra dieci anni, in Europa serviremo il caffè ai turisti cinesi e americani", prevede Tavares. Nel frattempo, i politici hanno riconosciuto il problema. Ma l'inversione di tendenza e la riduzione dei prodotti provenienti da Paesi a basso costo di manodopera sta portando all'inflazione. Il capo di Stellantis respinge anche le misure protezionistiche come le barriere tariffarie per i concorrenti cinesi: non farebbero che aumentare ulteriormente i prezzi. Avvertimento di "molti disordini sociali "C'è solo un modo per risolvere il problema", spiega Tavares. "Dobbiamo accettare la concorrenza. In Francia dico una cosa molto impopolare: bisogna lavorare di più!". Il problema principale dell'Europa, ha detto, risiede nella tecnocrazia e nella burocrazia; ora i cittadini devono imparare a lavorare in modo più efficiente". Inoltre, ha esortato il governo tedesco a non rinunciare al suo ruolo esemplare di politica di bilancio restrittiva - e quindi a tenere sotto controllo l'inflazione e il debito nazionale. Altrimenti, ha detto, c'è il rischio di "molti disordini sociali". Anche il leader del mercato mondiale delle auto elettriche, Tesla, è sceso a terra in questa difficile situazione. Lo dimostrano gli ultimi tagli ai prezzi effettuati dal capo dell'azienda Elon Musk. "Elon è arrivato nel mio mondo", dice Tavares. Sta abbassando i prezzi per raggiungere i suoi ambiziosi obiettivi di vendita. La guerra dei prezzi che ne deriverà sarà problematica per tutti i produttori che già soffrono di bassi margini di profitto, aggiunge. "Sarà una battaglia entusiasmante", afferma Tavares. L'industria automobilistica sarà caratterizzata dal "darwinismo". Tradotto con www.DeepL.com/Translator

- 119 risposte

-

- carburante

- bosch tecnologia

- (e 5 altri in più)

-

...ma sei sicuro che la macchina ha questa dimensione ache in Eu-Spec? Secondo me non esiste neanche come pneumatico estivo (se per esempio cerchi su Reifen.com, c'e niente).

- 984 risposte

-

- toyota ufficiale

- prius 2023

-

(e 6 altri in più)

Taggato come:

-

Secondo me e l‘ultimo update della versione standard, non ci sara una altra versione aggiuntiva.

- 18 risposte

-

Model year…oppure cosa e nuova a questa macchina? Tablet piu grande?

- 65 risposte

-

- a7 avant

- audi sportback

-

(e 13 altri in più)

Taggato come:

-

...forse devono crescere i prossimi trimestri le Gwh prodotti, perche con una media di 75kWh per macchina prodotta queste GWh di cellule bastano per 1.8Mio unite, saranno ca. 8Mio per anno. Con una quota bev tra 20 e 25% piu i phev solo in Cina (mercato di. 35Mio unite) questa capacita basterebbe solo per Cina, cosi dovrebbe essere piu per tutto l'anno.

- 5169 risposte

-

- transizione ecologica

- bev

-

(e 2 altri in più)

Taggato come:

-

MINI All Electric JCW 2025 - Prj. J01 BEV (Leak)

4200blu ha risposto a sonicwp7 in Scoops and Rumors

For the electric Mini Cooper, the story goes the other way around. The BMW brand’s new boss, Stefanie Wurst, has hailed the new hatch “the beginning of a new era”. The Mini Cooper will be electric first and run off the lines in May 2024. The EV is being developed in cooperation with Great Wall from China and has already been tested for quite a while. Still, the fifth-gen Mini has yet to make an official appearance. Media reports now mention power levels between 135 and 160 kW and two battery options with 40 and 54 kWh. (electrive)- 388 risposte

-

- 1

-

-

VW takes another step towards establishing a new local sub-brand for electric cars in China. German media reports the new label would incorporate the lines of the ID family, which Chinese customers have met with only moderate enthusiasm. Yet, VW already has a model in mind. The new Volkswagen China brand shall convey more lifestyle and appeal to a younger audience, writes Automobilwoche. This is in line with what Cupra is to do in Europe. Accordingly, the first model of the new label to launch in China will be the Cupra Tavascan, which VW showed a few days ago. The Cupra is to be made in China anyway. However, until now, the output in Anhui was reportedly slated exclusively for export, but it seems these plans have changed. The Tavascan will now be offered in China, not as Cupra but under the new label that has yet to be named. “In China, it will run under a different brand,” Automobilwoche quotes a high-ranking manager. Why Volkswagen is not launching Cupra in China mainly for practical reasons. “Setting up a completely new brand there is far too costly,” a company manager told Automobilwoche. “We won’t do that.” Besides, Volkswagen has had bad experiences with Škoda and the China start-up Jetta. Both are languishing below one per cent market share, and Škoda is likely to pull out of the country altogether soon, writes Automobilwoche. Instead, VW prefers launching a sub-label to the established Volkswagen brand. The report does not say precisely what the new sub-brand will be called. However, how strongly the new label will or will not be perceived as VW by Chinese customers will likely be decisive. Nio and BYD, for example, are mentioned as role models – BYD, in particular, took the top sales position in China from Wolfsburg in the first quarter. As for the Tavascan’s appeal, it is the most powerful MEB model to date and the company’s first all-electric SUV coupé. The all-important connectivity in China may be served by the model’s infotainment touchscreen that measures 15 inches diagonally, “the largest so far in a Cupra model,” writes VW. The current MEB models must make do with ten- or twelve-inch screens. Still, the infotainment system mainly originates from the ID.7, and whether it is enough to wow Chinese customers remains to be seen. Volkswagen in China, for China The Cupra Tavascan will reportedly be manufactured at Volkswagen Group’s Anhui plant in China, also for global markets. The company hopes to sell more than 70,000 vehicles per year. Following the completion of the Anting (SAIC VW) and Foshan (FAW-VW) plants, Anhui is the group’s third production facility for pure electric vehicles in the country. In contrast to the two previous MEB plants in China, VW is calling the shots there, acquiring a 75 per cent majority stake in the joint venture with JAC and renaming the company from JAC Volkswagen to Volkswagen Anhui. In the other two joint ventures, the Chinese partners still hold at least 50 per cent. Overall, Anhui as location appears to be taking on a more central role in Volkswagen’s latest “in China, for China” strategy, as Ralf Brandstätter, Group Board Member for China, called it when announcing a new local R&D venture ‘100%TechCo’ in April. “By consistently bundling development and procurement capacities and integrating local suppliers at an early stage, we will significantly accelerate our development pace.” The project, also called a “new company”, is to combine vehicle and component development and procurement when launching in 2024. Volkswagen expects the new unit to bring the German corporation in closer step with Chinese customers by integrating “state-of-the-art technologies from local suppliers,” among other things. “In a first step, 100%TechCo will steer the development of the models of the Volkswagen Anhui joint venture based on the MEB platform and will be responsible for the development of China-specific platform requirements and modules with a focus on electric mobility,” said Marcus Hafkemeyer, the new CEO of 100%TechCo. When announcing the new company, Volkswagen expected it to play a significant role in developing a future Volkswagen brand model to launch in 2024. (Automobilwoche/Electrive)

- 1514 risposte

-

- porsche

- scelte strategiche

-

(e 8 altri in più)

Taggato come:

-

Stellantis said its revenue grew 14 percent in the first quarter on higher shipments, helped by an improvement in semiconductor supply and strong net pricing power. Net revenues were 47.2 billion euros ($52 billion) in the January-March period, topping analyst expectations of 45.5 billion euros. Consolidated shipments were up 7 percent in the quarter to 1.48 million units, Stellantis said. "A better fulfilment of semiconductor orders is slowly but surely improving our capacity to produce vehicles," Chief Financial Officer Richard Palmer said in a media call on Wednesday. Palmer said the group is also seeing an improvement in its logistic situation in Europe, after issues with vehicles deliveries last year. Stellantis said its sales of battery-electric vehicles rose 22 percent in the first quarter and that it would add nine new BEV models to its offerings this year. The company reaffirmed full-year guidance for double-digit adjusted operating income margin and positive industrial free cash flows. Stellantis said new vehicle inventory was at 1.3 million cars at the end of March, reflecting a return to more normal levels. As supply-chain problems ease, automakers are set to struggle to maintain high prices that have underpinned margins in the aftermath of the pandemic. Successive price cuts from U.S. rival Tesla, whose Model Y was Europe’s best-selling car during the first quarter, is adding to the pressure. Ford Motor on Tuesday said it anticipated more downside on pricing as industrywide sales volumes "normalize." Palmer said Stellantis's pricing was "relatively stable" in the first quarter. "We do have a good order portfolio in Europe at the moment, so short term pricing should be relatively stable too but clearly that depends on order intake," he said. Europe has emerged as a focal point for a downturn as consumers in the region feel the pinch from a cost-of-living crisis and higher interest rates. Mercedes-Benz last week said demand in Europe is falling behind strong U.S. and Chinese markets. "Demand in holding up well notwithstanding lots of macro volatility" in Europe, Palmer said. 'Right time' to step down Palmer, 56, will be stepping down at the end of June after two decades at the company. The "timing is right" to leave Stellantis, Palmer said. "It's a reasonable time frame to go and do something different and I think the company is in great (Reuters/Bloomberg)

- 11932 risposte

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

64% delle Fiat vendute in Francia Q1/23 erano 500e, altri 21% 500ice......

- 1567 risposte

-

- 4

-

-

-

- anteprime auto

- avenger 2023

- (e 6 altri in più)