-

Numero contenuti pubblicati

14076 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

65

Tipo di contenuto

Forum

Galleria

Calendario

Download

Articoli del sito

Store

Blog

Tutti i contenuti di 4200blu

-

- 214 risposte

-

- 11582 risposte

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

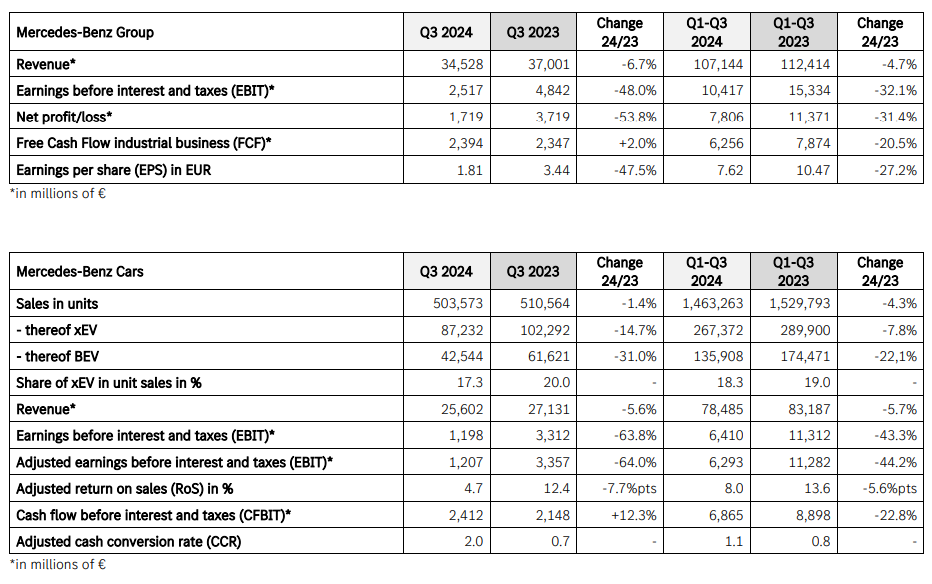

Una crisi che ha 3 ragioni: 1. l'attuale periodo di debolezza economica 2. un orientamento sempre più forte degli acquirenti verso i marchi nazionali 3. una generazione più giovane per la quale gli status symbol di un brand non sono più importanti, quindi tempi duri per i marchi occidentali/costosi anche in futuro.

- 1440 risposte

-

- 2

-

-

- italdesign

- jetta

-

(e 15 altri in più)

Taggato come:

-

Il problema non e questo aumento da 350 a 500 o 750. Il problema sono i posti (per HPC adesso pocchissimi, almeno in Germania) dove sono oppure meglio dove non sono - almeno per l'uso di una macchina come le esigenze mie. Faccio spesso 2000, 3000km senza neanche un metro su una autostrada. Oggi e possibile di fare benzina in ogni piccolo paesino dell Appennino, dei Pirenei, nella Barbagia, negli Alpi centrali, nei Highlands scozzese ecc. ecc. Quando siamo arrivato ad un punto dello sviluppo della infrastruttura, dove dove e possibile di fare il "pieno elettrico" in 5-10min ad una colonnina HPC in ogni di questi piccoli paesini montanare, poi una bev sarebbe forse accetabile, prima assolutamente no per me.

- 718 risposte

-

- 2

-

-

- cobalto

- sostenibilità

- (e 8 altri in più)

-

General Motors raised its earnings guidance for a third time this year as executives said strong pricing, robust demand and strategic cost management have set up the automaker for continued solid financial results. GM’s optimistic outlook accompanied third-quarter net income that was largely unchanged at $3.1 billion, while adjusted earnings before interest and taxes rose nearly 16 percent to $4.1 billion. Global revenue was up nearly 11 percent to $48.8 billion in the quarter ended Sept. 30. CEO Mary Barra told shareholders and investors that the company achieved its quarterly results the same way it is working toward long-term, consistent growth — through a disciplined approach to inventory, incentives, spending and costs, and with an eye on profitability for both gasoline and electric vehicles. "In the third quarter, we grew U.S. retail market share with above-average pricing, well-managed inventories and below-average incentives. In China, sales improved from the second quarter, and dealer inventory fell sharply," Barra said in an Oct. 22 letter to shareholders. "In addition, we remain on track to reach our 2024 EV production and profitability targets." With its latest results, GM raised the lower end of its forecast for 2024 full-year adjusted EBIT by $1 billion, to a new range of $14 billion to $15 billion. GM also narrowed its net income outlook to a range of $10.4 billion to $11.1 billion, from previous guidance of $10 billion to $11.4 billion. (Automotive News)

-

Eh si ,errore di battitura, ma anche il corretto 500kW è del tutto irrealistica come soluzione generale in senso di una densita delle colonnine simile una densita di oggi dei distributori benzina.

- 718 risposte

-

- 1

-

-

- cobalto

- sostenibilità

- (e 8 altri in più)

-

Eh si certo, errore mio, 500kW, ma quante di queste esistono oggi in Italia?? E in futuro ad un grande autogrill non basta una, devono essere almeno 10-20, quindi parliamo di di 5-10MW, con quale infrastruttura esistente vuoi creare questo? Hai bisogno di una rete completamente nuova della media tensione. Chi paga?

- 718 risposte

-

- cobalto

- sostenibilità

- (e 8 altri in più)

-

E quante colonnine a 500MW esistono in Europa/in Italia al momento ?

- 718 risposte

-

- 1

-

-

- cobalto

- sostenibilità

- (e 8 altri in più)

-

Mah...sapiamo tutti come era con Tonale dopo 1-2 anni in vendita.......... https://www.hdmotori.it/alfa-romeo/articoli/n561608/alfa-romeo-tonale-20-mila-ordini-suv-europa/ https://www.***filtro automatico***/435501-alfa-romeo-tonale-entro-fine-anno-35-mila-ordini

- 1991 risposte

-

- 1

-

-

- kid

- alfa romeo kid

-

(e 6 altri in più)

Taggato come:

-

Non sono d‘accordo - in Germania secondo una analisi dei dati assicurative (fatto dalla unione dei assicuratori) al momento piu di un terzo di possessori bev vanno indietro ad una ice quando cambiano macchina. Stessa esperienza di un mio amico, conce Fiat/Alfa, che nei ultimi mese ha parecchie clienti che danno indietro le bev (sopratutto 500e) e comprano ancora auto ice, perche sono insoddisfato con lo uso della bev, poco pratico, complicato e scomoda. Accettate un'enorme perdita di valore in questo processo, perche una 500e tra 2-3 anni e 30-40.000km al momento qui ha un valore di „trade in“ di 8-9000.-€. Ma molti semplicemente non hanno piu voglia per una bev.

- 11582 risposte

-

- 2

-

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

Non credo che in tutta l‘europa bastano c3 e t03 per raggiungere una quota bev di 20% delle vendite totale.

- 11582 risposte

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

no, la carovana e andata avanti, appena comprato una S24 come regalo per un amico „made in Vietnam“ 😜

-

Primi registrazioni in Europa https://www.theguardian.com/technology/2024/oct/08/tesla-cybertruck-too-big-and-sharp-for-european-roads-say-campaigners

- 256 risposte

-

- tesla cybertruck

- tesla

-

(e 5 altri in più)

Taggato come:

-

Perche e gia nata cosotoso, piattaforma ottima per un produttore premium con volume adeguato, ma in un gruppo delle scatole modiche con motore unico disegnato dei contafagioli non fa senso, perche non va insieme con tutto il resto della baracca 😎

- 3038 risposte

-

- 3

-

-

-

- alfa romeo spy

- stellantis

-

(e 2 altri in più)

Taggato come:

-

Stellantis ready to cut ICE car production in Europe to meet CO2 target Jean-Philippe Imparato, COO of Stellantis's Europe region, says that EV production will take priority over internal-combustion cars in 2025 as EU emissions rules tighten. PARIS — Stellantis is ready to cut production of cars with internal combustion engines next year to meet its 2025 EU emissions targets rather than pay fines, the group’s Europe boss said. The production cuts could start as early as Nov. 1, said Jean-Philippe Imparato, who on Oct. 10 was named COO for the automaker's Europe region, which includes Eurasia and Turkey, as part of a broad management shake-up. Imparato was formerly CEO of Alfa Romeo and before the Stellantis merger in January 2021 was CEO of Peugeot at PSA Group. Some automakers, including BMW and Renault Group, have called for changes or delays to the stricter CO2 rules, which will require automakers to get 20 to 25 percent of their sales from full-electric vehicles, depending on estimates. The EV market share in the EU was less than 13 percent through August. Stellantis opposes any delay or weakening of the rules. CEO Carlos Tavares said at the Paris auto show on Oct. 15 that Stellantis would meet the targets, and that any delay to the new rules would mean that European automakers fall further behind technologically advanced Chinese brands. Imparato said in an Oct. 14 interview at the Paris show that Stellantis will need to double its EV share next year to 24 percent of total vehicle sales to meet the 2025 target. If demand for EV remains at the current levels, the only way to achieve the goal and avoid fine will be to reduce output of ICE car, Imparato said. Aligning production and demand “My first task is to align production for vehicles sold in the first quarter of 2025” by the first week of November, he said. It takes about 60 days to get a car from the production line to being registered whether the end customer is private or business buyer, or a dealer. The EU rules that take effect Jan. 1 will set an overall fleet CO2 emission target of 95 grams per kilometer — down from average actual emissions of 106.6 g/km in 2023, according to provisional data from the European Environment Agency. Automakers that miss their individual targets will face fines of €95 per excess gram per vehicle. According to Renault CEO Luca de Meo, automakers could face fines of €15 billion. Analysts at Barclays Bank quoted in The Financial Times put the figure at more than €10 billion. One potential advantage for Stellantis is the group’s recent investment in Leapmotor, a Chinese automaker that has started to sell two EVs in Europe. Cars sold by the Leapmotor International joint venture, in which Stellantis has a 51 percent stake, will count in the group’s emissions figures. Imparato declined to give a sales target for Leapmotor next year in Europe, but added that, including Leapmotor vehicles, the average combined share of Stellantis EVs would stand at about 20 percent. To ensure Stellantis is on track to meet its emission target, Imparato said he will base its overall production budget on its EV order portfolio. “Given that we produce only vehicles covered by a customer order, we’ll assemble as many ICEs as those needed to keep the EV share at the required level,” he said. Existing inventory issues Production cuts to ICE cars based on emissions targets could add to Stellantis’s woes in Europe, at least in the short term. The automaker said this week that deliveries in Europe were down 17 percent in the third quarter because of delays to key models such as the Citroen C3 and e-C3. It has recently suspended production at the Mirafiori factory in Turin, which builds the Fiat 500e small EV and two Maserati models, until Nov. 1, citing weak demand. On Oct. 16 it said it was suspending activities at engine plants and the factory that builds the Fiat Panda minicar in Italy for several days next month. Stellantis is also facing a glut of inventory in North America, where deliveries are down 36 percent. The company’s share price has dropped sharply after disappointing first-half profits and a profit warning issued at the end of September. Levers to boost EV sales Imparato said he had several levers to pull to increase EV sales, with targets tailored to individual European markets based on EV penetration. For example, he said dealers in Spain and Italy, where EV market share is less than 5 percent, won’t have to sell 20 percent EVs next year, but those in the Netherlands might have to reach 50 percent. The company will increase dealer incentives on EVs, he said. “If they play the game, they’ll earn big money,” Imparato said, adding that the new incentive program will reward the whole distribution chain, from salespeople to zone managers. A large dealer, who asked to remain anonymous, said that additional incentives on EVs would be more than welcome, but they have not been communicated yet. After the new EV incentives are in place, if demand for ICE cars exceeds the share projected to meet emissions targets, Imparato said Stellantis could raise prices on ICE vehicles “on a flexible basis, by model, brand and market.” Another way to increase EV sales is through helping dealers handle potential shortfalls on leasing and long-term rental contracts, he said. In the past, residual values have been set relatively high to keep monthly payments low. But residual values on used EVs have fallen sharply, including in Europe, after Tesla started a global price war in late 2022. That has left automakers and dealers facing significant losses on used cars or cars coming off lease. Dealers are now facing a “mountain” of EVs coming back from lease contracts signed in 2021-22, and automakers have to help them on residuals, Imparato said. The need to avoid the additional burden is one more reason to align production with EV demand in the future, he added. Automakers will have to learn how to leverage the long-term value of EVs, he said. “You can sell an EV three times,” Imparato said, meaning the initial lease and two more leases as a used vehicle. For that to happen, used EV values will need to be carefully calculated, he said, starting with the initial lease terms. (ANE)

- 11582 risposte

-

- 5

-

-

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come:

-

...eh si...stessa cosa con Winterkorn e dieselgate - se lui ha saputo cosa fanno nel ripartimento dei motori, poi e responsabile per tutto perche ha lasciato succedere, invece se e vero come dice lui, che non ha saputo niente, poi allora non tiene sotto controllo i suoi dipendenti, anche una no go per un AD.

-

non lo scopriremo mai, perché tutte queste auto scompaiono nelle collezioni e non saranno mai guidate.

- 148 risposte

-

- 3

-

-

-

- ferrai

- ferrari supercar

-

(e 2 altri in più)

Taggato come:

-

oppure no - BAIC, hanno 0,3% piu che Li Shufu. ...e se non sbaglio io anche 2 cilindri in piu 😝

- 148 risposte

-

- ferrai

- ferrari supercar

-

(e 2 altri in più)

Taggato come:

-

....quindi alla fine Mercedes .... 😂

- 148 risposte

-

- 1

-

-

- ferrai

- ferrari supercar

-

(e 2 altri in più)

Taggato come:

-

Sono cliente Maserati, ma neanche a me la Nordschleife non interessa neanche minimalmente 😄

- 4391 risposte

-

- 2

-

-

-

- quattroporte m183

- maserati newgt

-

(e 35 altri in più)

Taggato come:

- quattroporte m183

- maserati newgt

- m240

- maserati 100% electric

- m6u

- m157

- m9s

- maserati f-uv

- m184

- mmxxi

- maserati bev

- maserati elettrica

- m156

- nuove maserati

- levante mca

- m183

- m189

- maserati supercar

- quattroporte mca

- maserati

- maserati full electric

- maserati ev

- m161

- levante m184

- future maserati

- maserati grecale

- grecale

- maserati d-uv

- folgore

- nuovi modelli

- maserati spy

- maserati mc20

- new v6

- 2.0 phev

- ghibli mca

- 2.0 mhev

- mmxx

-

Non vedo cosi totale, brand come Ferrari, Lambo, Rolls, Porsche (ridimensionato), BMW e Mercedes (ridimensionato molto forte) rimangono, forse luna o l'altra in mano asiatico.

- 4962 risposte

-

- transizione ecologica

- bev

-

(e 2 altri in più)

Taggato come:

-

https://carnewschina.com/2024/10/17/diesel-version-of-the-tank-300-suv-exposed-by-regulator-ahead-of-launch-in-china/

- 25 risposte

-

- wey tank 300

- wey ufficiale

- (e 4 altri in più)

-

Altre CIG a Novembre.... https://www.quattroruote.it/news/industria-finanza/2024/10/16/stellantis_si_fermano_anche_termoli_pomigliano_e_pratola_serra.html?_gl=1*b721xe*_up*MQ..*_ga*NzIxODE2OTA2LjE3MjkxNTUxOTM.*_ga_6JWB8WXKTP*MTcyOTE1NTE5Mi4xLjAuMTcyOTE1NTE5Mi4wLjAuMA..

- 11582 risposte

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come: