Tutti i contenuti di 4200blu

-

BMW X1 LCI 2027 - Prj. U11 LCI (Spy)

Zipse, durante la presentazione della nuova classe lo scorso anno, ha affermato che nei prossimi 2-3 anni l'intera gamma di modelli (nuovi + LCI pesante) passerà alla panaramic vision.

- Ferrari Luce 2026 - Prj. F244 (Spy)

-

Ferrari Luce 2026 - Prj. F244 (Spy)

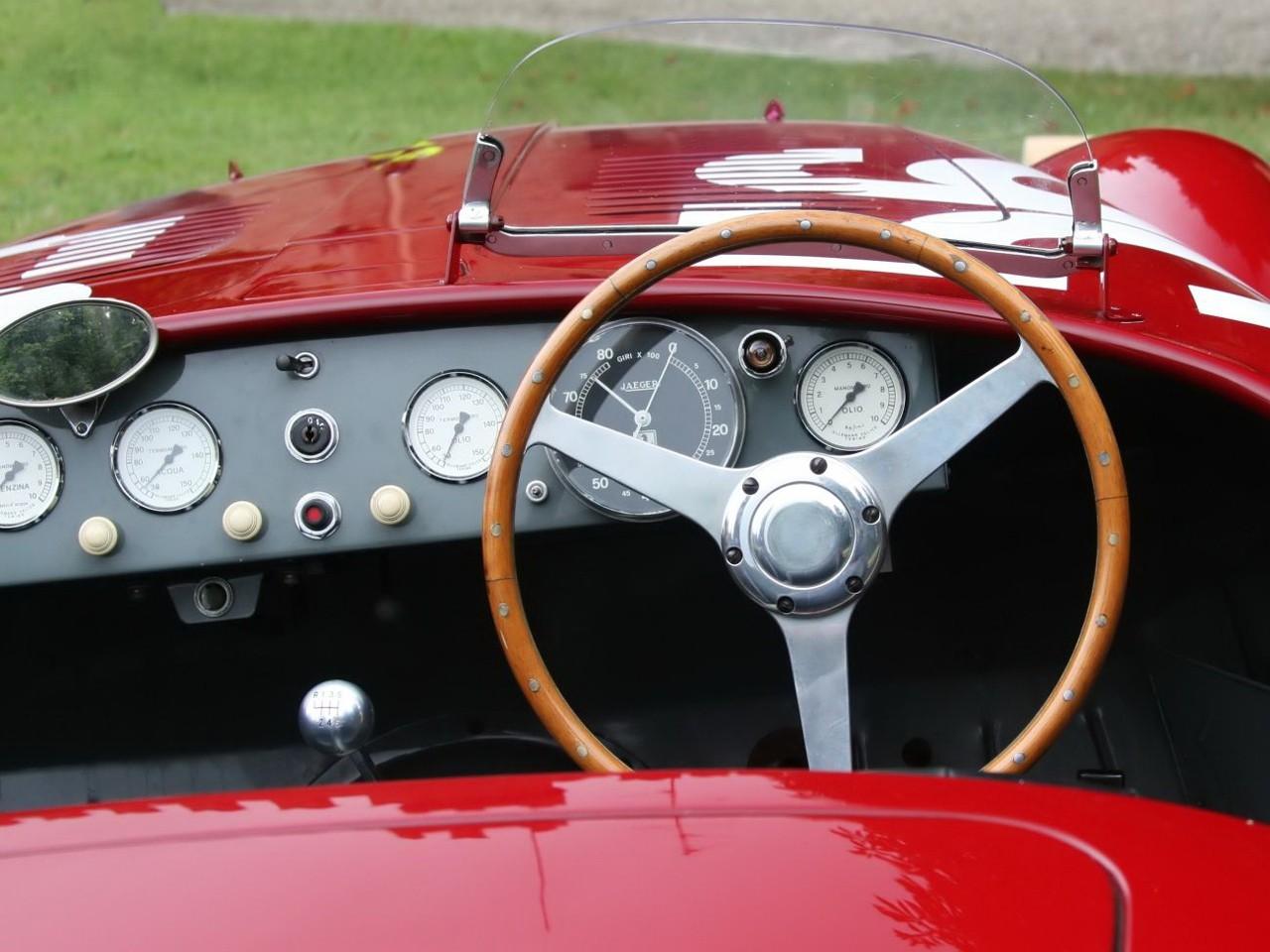

Commento di AutoMotor&Sport - molto piu positivo rispetto le reazione qui dentro mi sembra…..😁 Il passato incontra il futuro e plasma il presente E possiamo rassicurare tutti coloro che si aspettavano qualcosa di amaro. La Ferrari Luce sarà fantastica. Ha un passato e guida verso il futuro, ma è completamente nel qui e ora. Ecco come è andata: Ferrari ha pensato di coinvolgere nuove persone per il nuovo modello, che non sostituisce nessun altro ma completa la gamma. Non giovani, ma esperti, con competenze creative e di successo. Parola chiave Apple, per la cui filosofia di design, dal telefono all'orologio allo shop, era responsabile Sir John Ive. Il cinquantenne, che vuole essere chiamato Jony, coltiva, e qui ci sbilanciamo, il design tedesco. Più precisamente lo stile della Braun, caratterizzato da Dieter Rams. Basta confrontare la calcolatrice dell'iPhone con una calcolatrice Braun. Tutto chiaro? (AM+S / DeepL)

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

- Lancia Gamma - D-UV 2026 - Prj. L74/L4U (Spy)

- Lancia Gamma - D-UV 2026 - Prj. L74/L4U (Spy)

-

Lancia Gamma - D-UV 2026 - Prj. L74/L4U (Spy)

A marzo 2025 il managment di Stellantis Deutschland ha pubblicato questo statement ufficiale: „Lancia rimane fedele alla sua strategia di espansione, compreso un possibile ingresso nel mercato tedesco. Tuttavia, dopo un'attenta valutazione con il nostro nuovo team dirigenziale, abbiamo deciso di ottimizzare i tempi di questo ingresso nel mercato per ottenere il massimo impatto possibile. Nel frattempo, il nostro obiettivo è rafforzare la nostra presenza nei mercati esistenti e creare una solida base per un'ulteriore crescita. L'interesse per Lancia è più forte che mai, sia da parte dei clienti che dei concessionari. Questa decisione strategica ci consentirà di entrare nel mercato tedesco al momento giusto e di sfruttare al massimo il potenziale del marchio. Una data concreta per l'ingresso nel mercato tedesco non è ancora stata fissata e viene continuamente rivalutata tenendo conto dell'attuale situazione di mercato.„ (traduzione DeepL) …quindi niente data preciso e niente modello preciso per il rientro.

- 901 risposte

-

-

- 2

-

-

- aurelia

- l74

- lancia

- lancia aurelia

-

Taggato come:

-

[CHN] Xiaomi YU7 2025

Diciamo che la Ferrari è il massimo dell'ingegneria, mentre il cinese è solo spazzatura elettronica, proprio come una Apple Watch che due anni dopo l'acquisto è solo un rifiuto speciale perché tecnicamente superato dal nuovo modello, mentre una Patek è per l'eternità.

-

Transizione ecologica ed il futuro della mobilità

Shift in strategy: Canada abolishes EV sales quotasCanadian Prime Minister Mark Carney announces a new national automotive strategy. As part of this, he eliminates the electric vehicle sales quotas introduced by his predecessor and instead introduces stricter emission standards for manufacturers and purchase incentives for consumers. The Canadian government is scrapping its requirement that 60 per cent of all new cars must be electric by the end of the decade, and 100 per cent by 2035. The gradually increasing sales quotas for manufacturers and importers were introduced in 2023 under former Prime Minister Justin Trudeau, with an initial milestone of 20 per cent electric vehicle share by 2026. For clarity: although the regulation referred to ‘Zero Emission Vehicles (ZEV),’ it also included plug-in hybrids with a specific electric range alongside battery-electric cars. Mark Carney, leader of Canada’s Liberal Party and Prime Minister since spring 2025, is now overturning this regulation and introducing a package of measures to accelerate the transition to alternative powertrains while stabilising Canada’s automotive industry amid trade pressures from its neighbour, the USA. To achieve this, Carney is introducing stricter greenhouse gas (GHG) emissions standards for vehicle models from 2027 to 2032, no longer mandating automakers to produce electric vehicles but instead allowing them to decide how to meet the targets using their chosen powertrain mix. The production of zero-emission vehicles will still be incentivised by the emissions standards, as the targets cannot be met without them. As a further measure, Carney is announced a tradable [emissions] credits systemto attract foreign automakers to Canada. He expects this system to result in 75 per cent of new cars sold in Canada being electric by 2035. This is explicitly a target, not a binding sales quota. The Prime Minister considers it realistic that Canada will achieve a 90 per cent EV share by 2040. (electrive)

- [CHN] Xiaomi YU7 2025

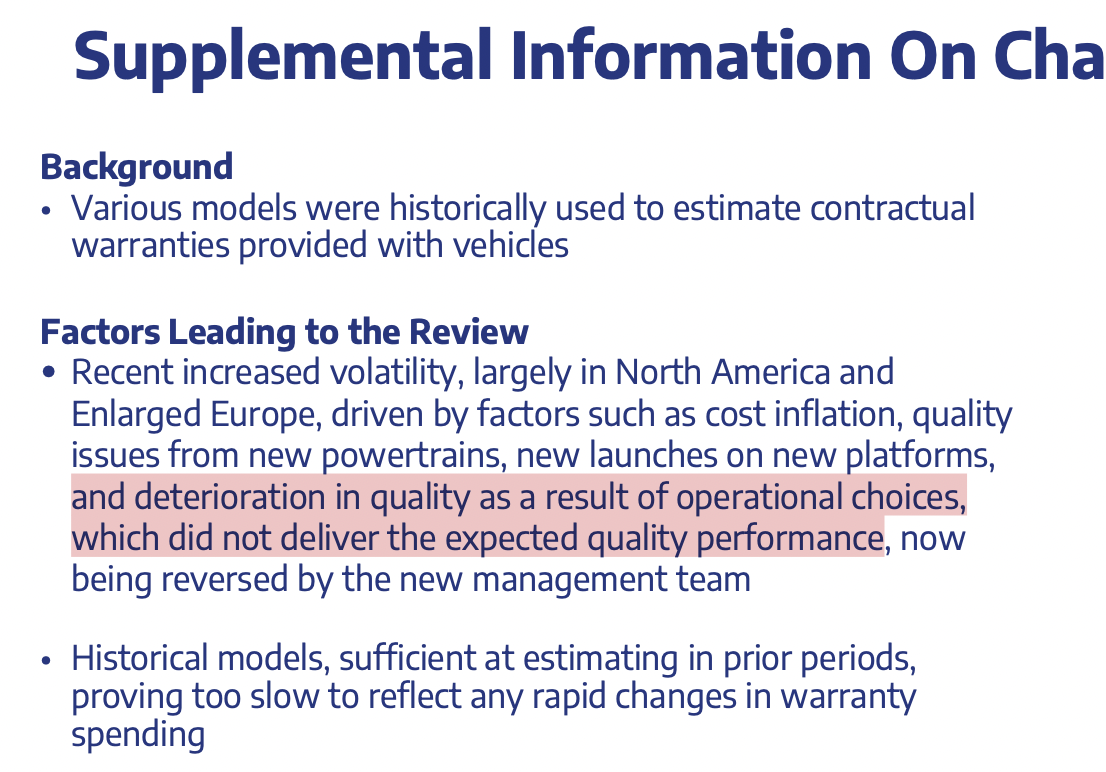

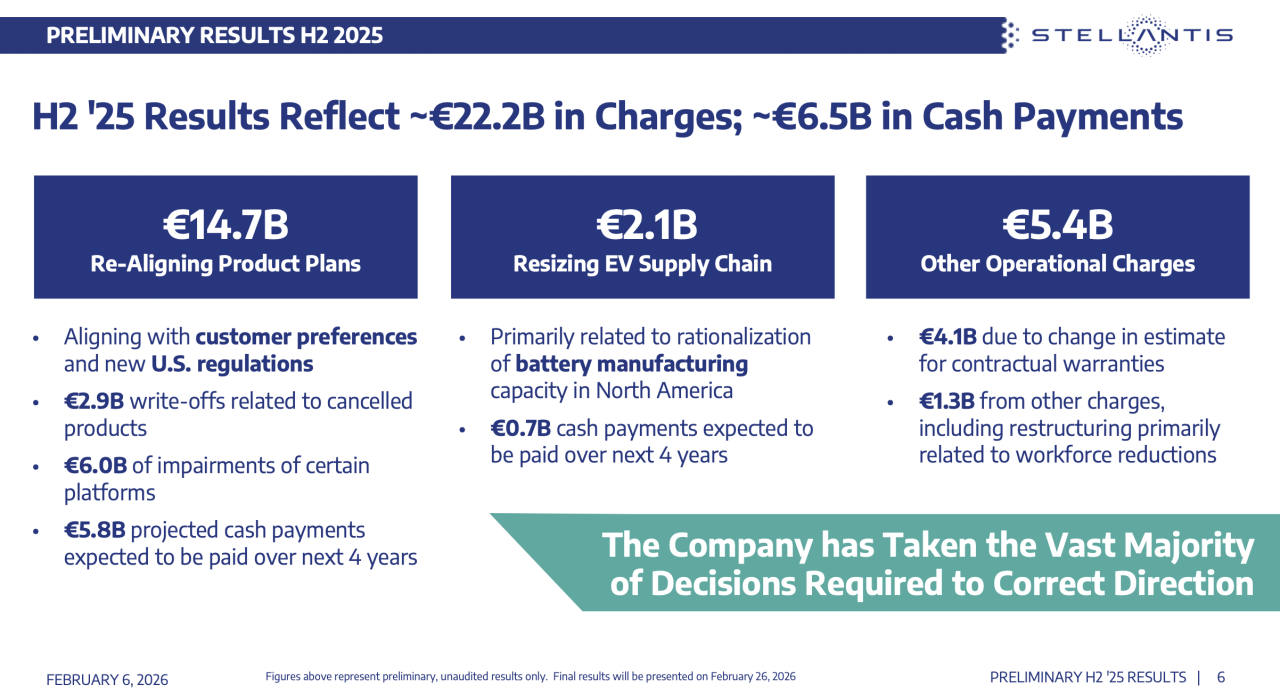

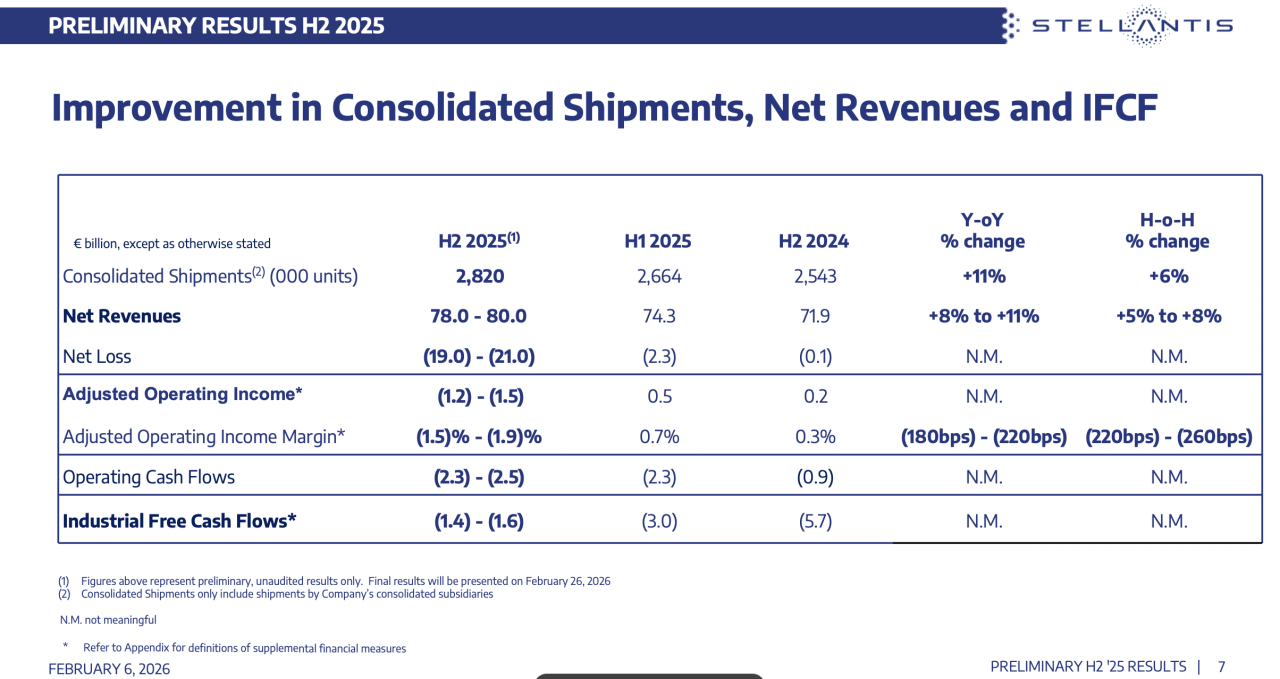

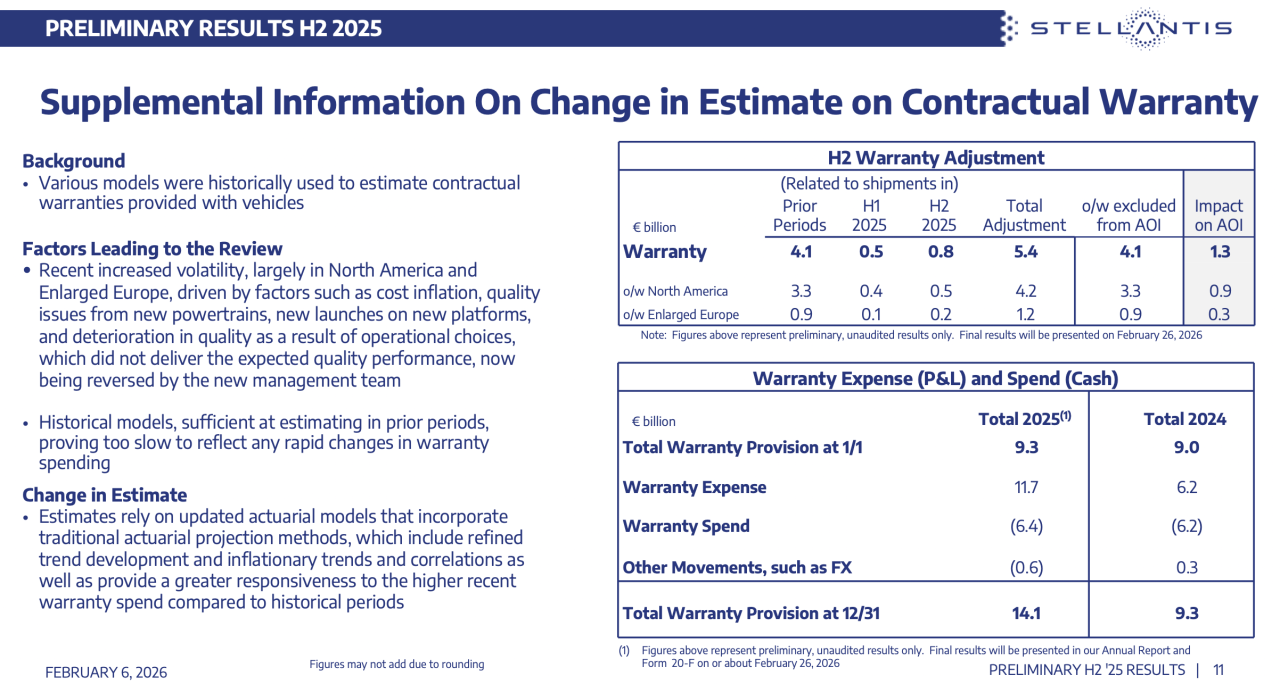

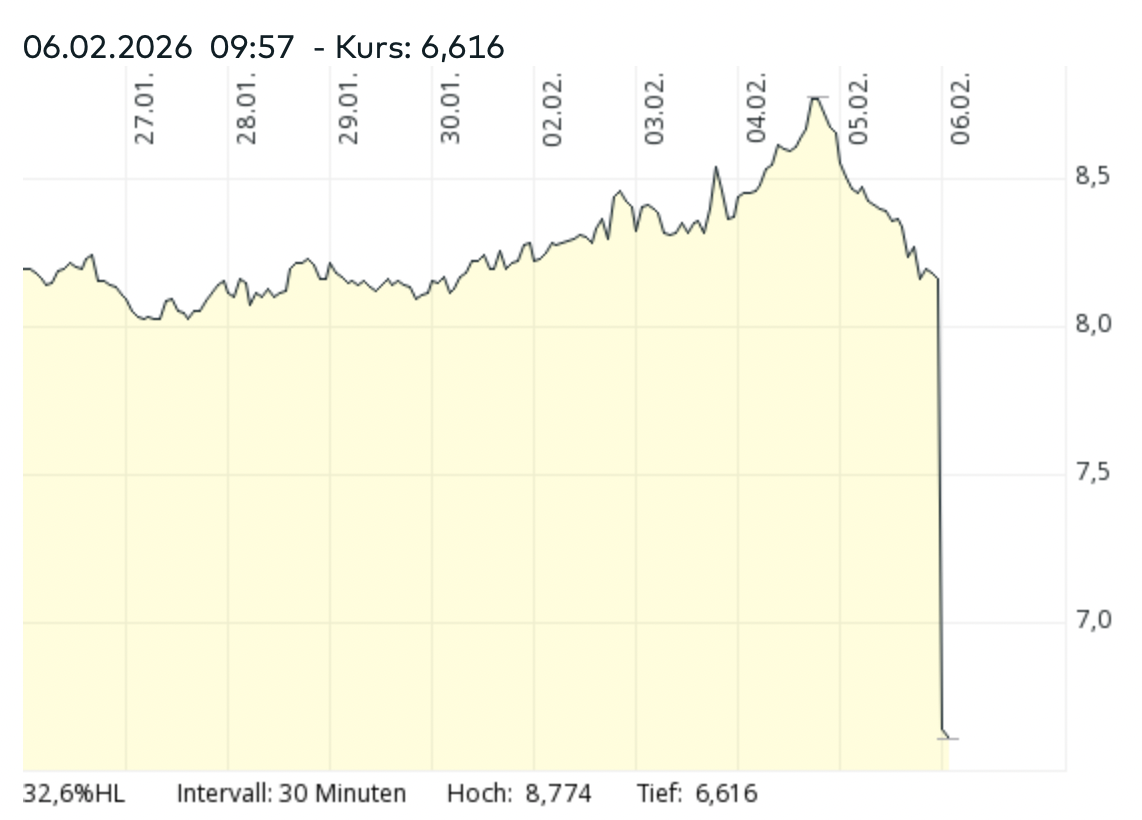

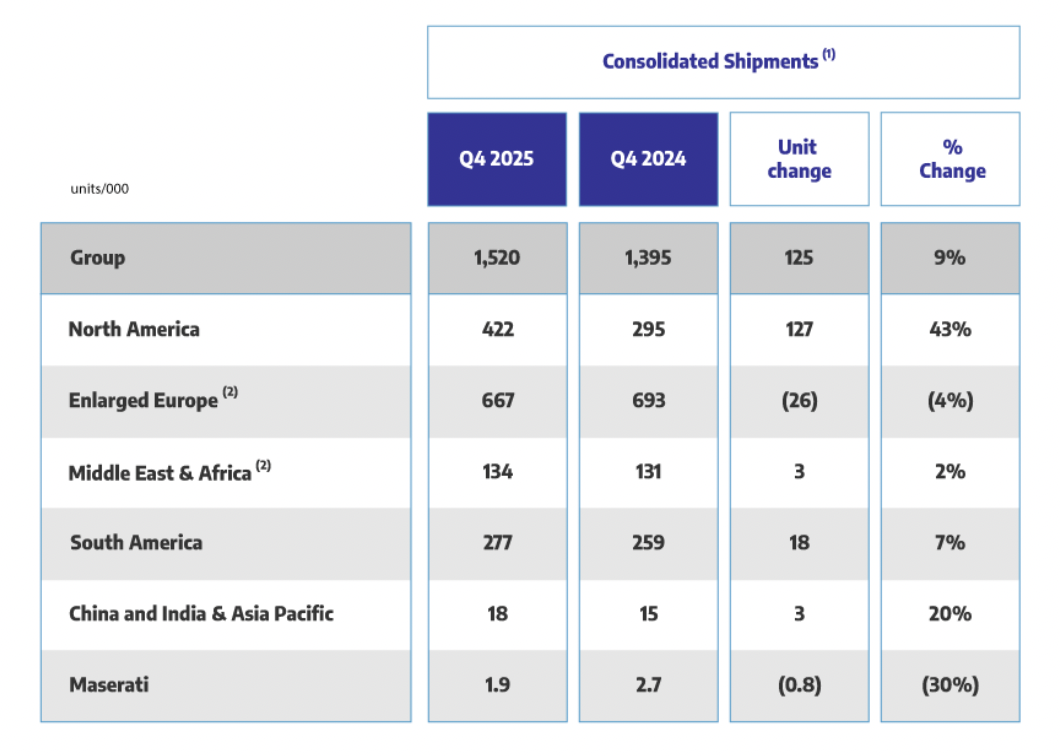

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

-

Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

Con un mercato di circa 14 milioni di unità, che sicuramente non crescerà nel medio termine, i nuovi concorrenti asiatici che prendono volumi in questo mercato già limitato, una struttura di modelli che non è vendibile a livello globale (ad eccezione forse di alcuni prodotti di nicchia molto piccoli) e una crescente pressione sui costi, sarà inevitabile procedere a massicci adeguamenti delle capacità.

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

-

BMW iX1 2027 - Prj. NB5 (Spy)

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

- Scelte strategiche gruppo Stellantis NV

- Scelte strategiche gruppo Stellantis NV

- Scelte strategiche gruppo Stellantis NV

- Scelte strategiche gruppo Stellantis NV

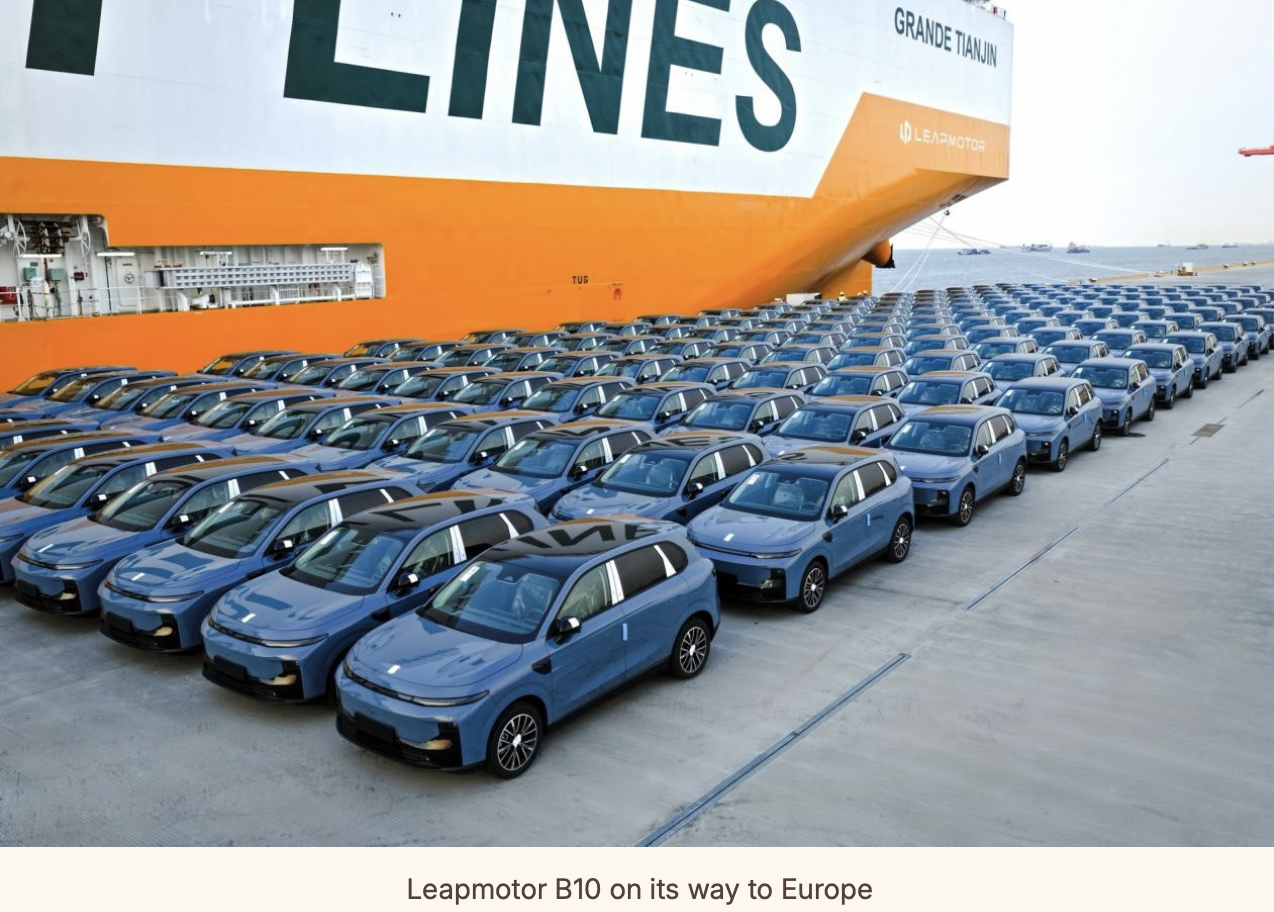

Leapmotor aims to break 1 million units sales in 2026, COO shared The Stellantis-backed Chinese automaker Leapmotor aims to break 1 million units in global sales in 2026, the company’s COO Xu Jun shared. It is 76% more than the brand’s worldwide deliveries in 2025. Leapmotor is a rapidly developing Chinese automaker that made headlines in late 2023 with Stellantis acquiring a 20% of its stake in the company for 1.5 billion EUR (1.77 billion USD). In December 2025, Chinese state-owned enterprise FAW acquired 5% equity in Leapmotor for around 3.74 billion yuan (530 million USD). Last year, Leapmotor delivered 596,555 units worldwide, up 103% Y-O-Y. The brand’s current model line includes nine vehicles: the Lafa 5 (B05) and the T03 hatchbacks, the B01 and the C01 sedans, and the A10 (B03X), the B10, the C10, the C11 & the C16 crossovers. This year, the automaker will also launch the D19 flagship SUV with an 80.3 kWh battery and the D99 luxury MPV. Leapmotor 2026 sales targetIt seems that Leapmotor’s top managers expect to get a sales boost from the launches of new models and the broadening of international presence. The brand’s chief operating officer, Xu Jun, revealed the brand’s exact sales target for 2026 in his letter to colleagues dedicated to the Chinese New Year celebration. According to the letter, Leapmotor aims to sell 1,050,000 units in 2026, up 76% year-over-year. It is worth noting that Leapmotor delivered 32,059 cars in January 2026. It is 27.4% more than the same period last year. However, the brand’s monthly sales declined by 47%. Leapmotor COO Xu Jun highlighted that the company will act in a “protective mode” this year, ensuring that each model achieves stable sales instead of creating blockbuster models. Other goals of the automaker are simplifying policies and increasing profits. (CNC)- Fiat -> FCA -> Stellantis - Filosofia su una holding multinazionale

Mi piacerebbe che queste ipotesi corrispondessero alla realtà, ma al giorno d'oggi, in cui motore, sistema di controllo, impianto elettrico di bordo e l'intero sistema di assistenza alla guida formano un'unità interconnessa, mi è difficile immaginare che un tale scambio sia possibile su tutta la gamma di modelli a costi ragionevoli.